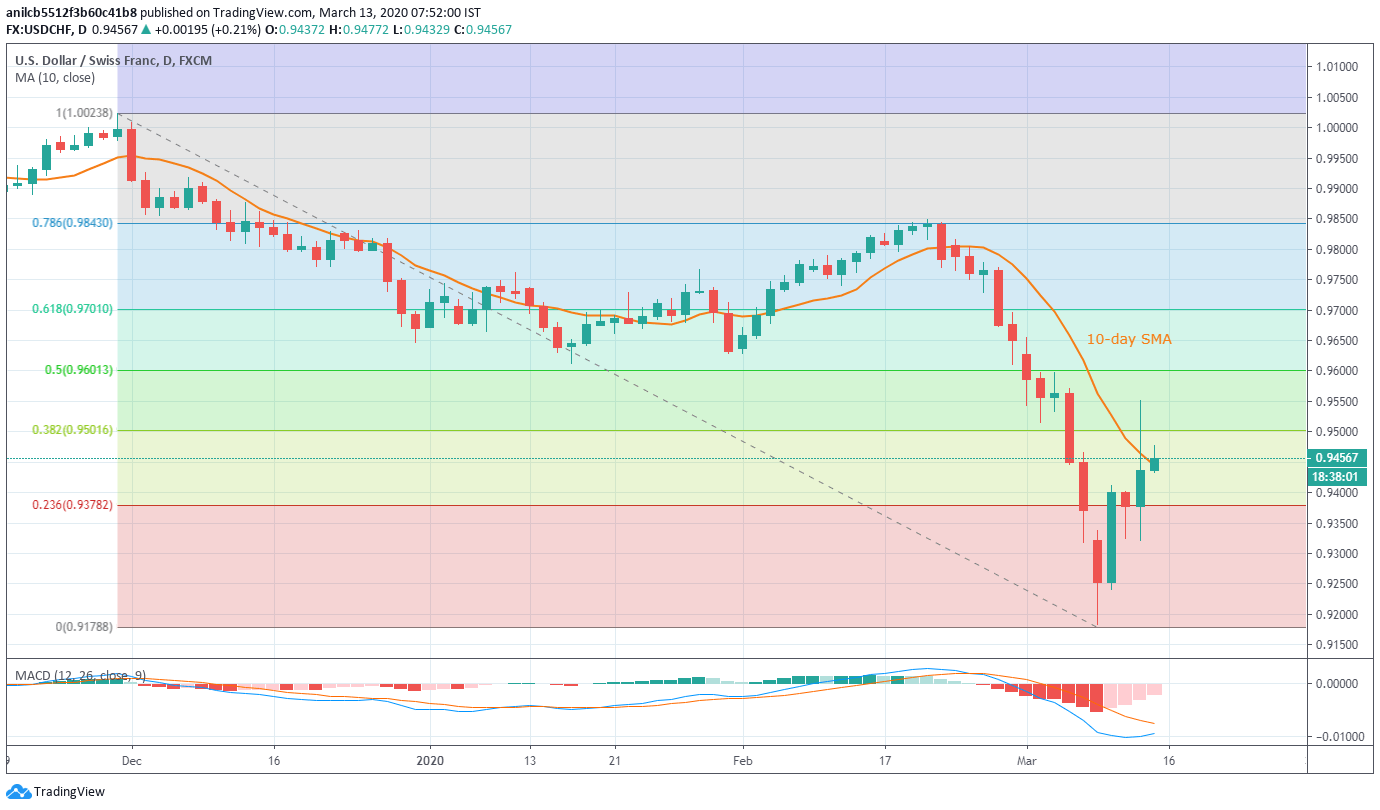

- USD/CHF holds onto recovery gains from 23.6% Fibonacci retracement level.

- 50% of Fibonacci retracement, January month low on the bulls’ radars.

- Sellers can take entry below 0.9320.

USD/CHF adds 0.22% to its previous recovery, currently crossing 10-day SMA, while trading near 0.9460 during the early Friday. The pair manages to remain positive beyond 23.6% Fibonacci retracement of its fall from November 2019.

As a result, buyers can aim for further upside beyond a 38.2% Fibonacci retracement level of 0.9500.

In doing so, 50% of Fibonacci retracement and January month’s low, respectively near 0.9600 and 0.9615, can please the bulls.

During the pullback, 0.9320 can act as additional support below the 23.6% Fibonacci retracement level of 0.9378.

However, a daily closing below 0.9320 will make the quote vulnerable to extend the south-run towards 0.9000 mark.

USD/CHF daily chart

Trend: Further recovery expected