- USD/CHF remains depressed as the US dollar struggle to extend the previous day’s recovery moves.

- Monthly resistance line, yearly support restrict immediate moves.

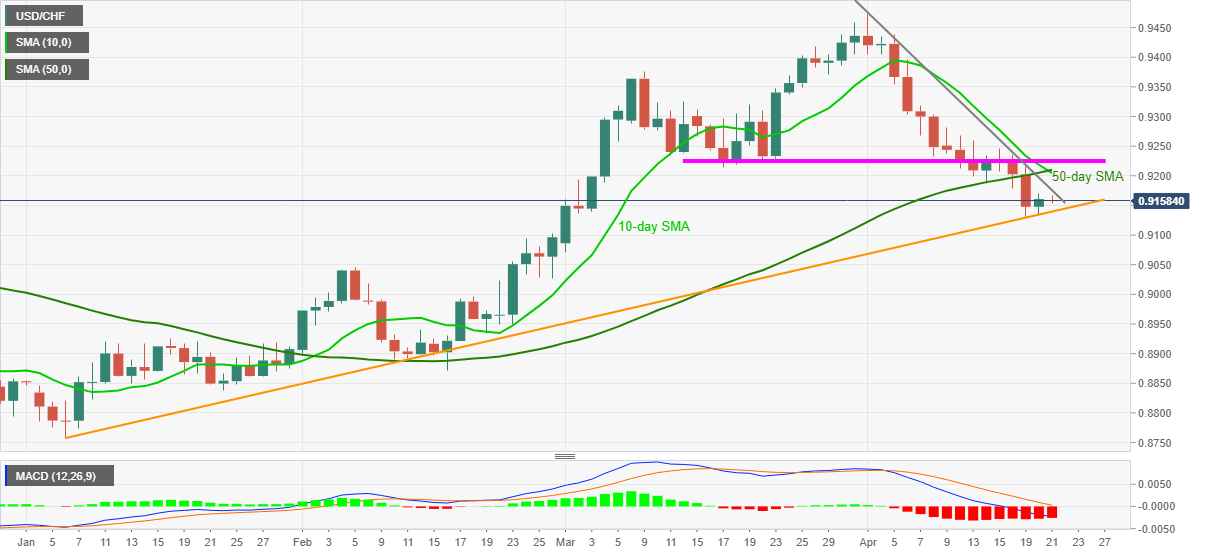

- Confluence of 50-day, 100-day SMA, five-week-old horizontal area add to the upside filters.

- Bears can target early February tops on the break of the key support line.

With the recent pullback from 0.9167, USD/CHF not only reversed the early Asian gains but also prints intraday losses while heading into Wednesday’s European session.

As a result, the bearish MACD signals doubt the USD/CHF pair’s corrective pullback, portrayed the previous day.

However, an ascending support line from January 06, around 0.9140, holds the door to the pair’s south-run towards the February 05 peak of 0.9045. During the fall, the latest low of 0.9128 may offer an intermediate halt.

On the flip side, an upside clearance of the monthly resistance line near 0.9175 will push the USD/CHF bulls to battle with the 0.9205-10 confluence comprising 10-day and 50-day SMA.

Also acting as an upside barrier is the 0.9225-30 horizontal area including multiple levels marked since March 17.

Overall, USD/CHF stays on the bear’s radar despite Tuesday’s recovery moves.

USD/CHF daily chart

Trend: Further weakness expected