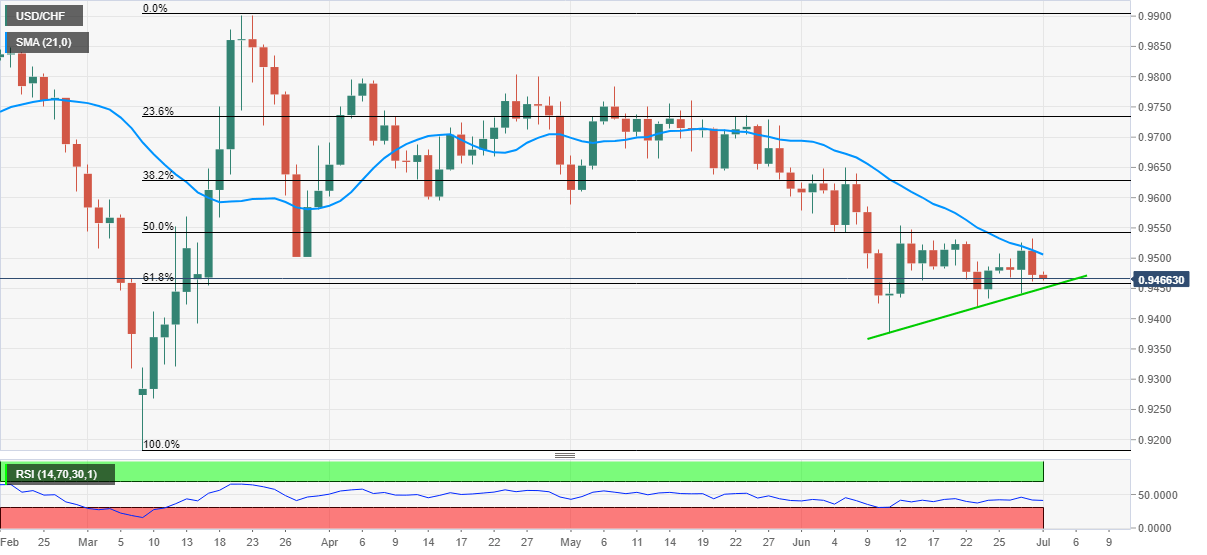

- USD/CHF keeps the US session range between 0.9460 and 0.96480.

- Failure to cross 21-day SMA drags the quote to near-term trend line support.

- 50% of Fibonacci retracement adds to the upside barrier.

USD/CHF drops to 0.9468, down 0.09% on a day, during the pre-European session on Wednesday. Even so, the late Tuesday’s trading range stays intact. However, the pair’s U-turn from 21-day SMA keeps sellers hopeful.

As a result, an upward sloping trend line from June 11, at 0.6450 now, pop-up on the sellers’ radars as immediate support.

Though, the pair’s inability to balance around 0.6450 could boost the downside momentum towards June 23 low near 0.6420 and 0.6400 threshold ahead of the previous month’s low near 0.6375.

Meanwhile, 50% Fibonacci retracement of the pair’s March month upside, near 0.9545, will offer an additional challenge to the buyers past-21-day SMA level of 0.9506.

Additionally, May 01 low close to 0.9590 will be an extra hurdle for the bulls to justify their strength past-0.9545.

USD/CHF daily chart

Trend: Further weakness expected