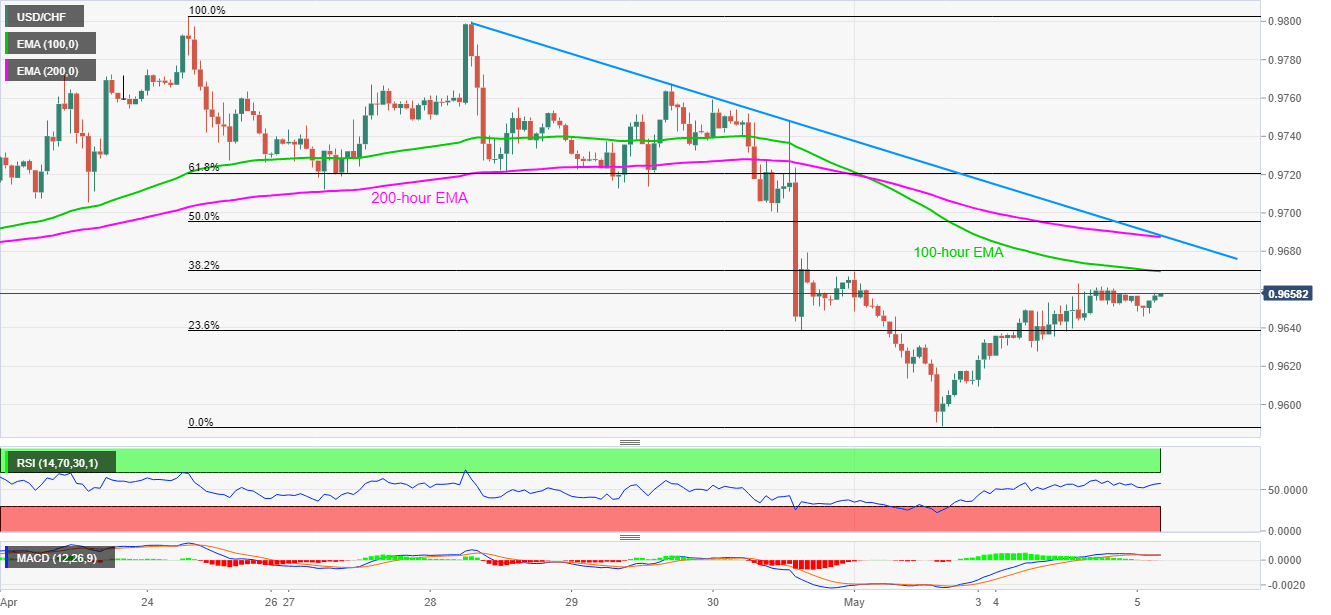

- USD/CHF holds onto recovery gains from the five-week low.

- 100-hour EMA, 38.2% Fibonacci retracement acts as immediate resistance.

- The weekly falling trend line, 200-hour EMA restricts further upside.

- Sellers will look for entry below 23.6% Fibonacci retracement.

USD/CHF clings to modest gains of 0.05% while taking rounds to 0.9657 during the pre-European session on Tuesday. In doing so, the pair extend recovery gains from Friday’s low of 0.9589, also the five-week bottom.

Though, a confluence of 100-hour EMA and 38.2% Fibonacci retracement of April 24 to May 01 fall, around 0.9670 restricts the pair’s immediate upside.

If at all the USD/CHF prices rise beyond 0.9670, 200-hour EMA and a weekly falling trend line, near 0.9690, challenges buyers before pushing them to late-April low surrounding 0.9715.

On the downside, a clear break below 23.6% Fibonacci retracement of 0.9638 offers nearby support during the quote’s pullback.

Should there be an additional weakness below 0.9638, the return of 0.9615 and 0.9588 can’t be ruled out.

USD/CHF hourly chart

Trend: Pullback expected