- USD/CHF slips from a two-week high.

- 61.8% Fibonacci retracement, 200-day EMA add to the resistances.

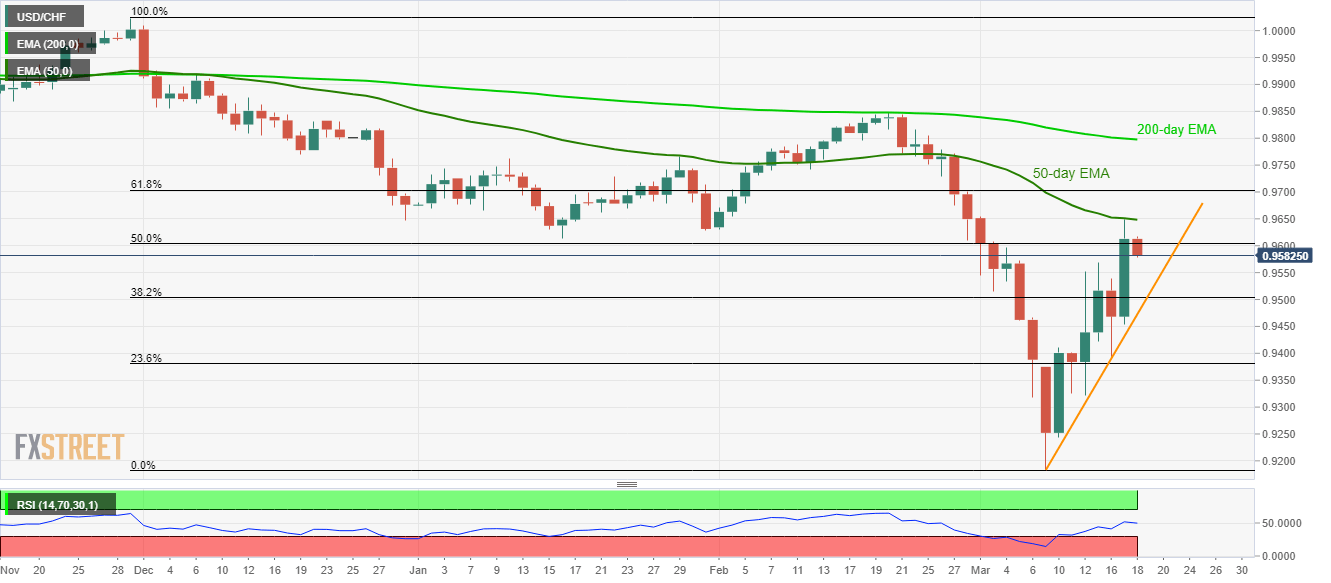

While extending its U-turn from 50-day EMA, USD/CHF drops 0.30% to 0.9583 ahead of the European session on Wednesday.

The pair currently declines towards 38.2% Fibonacci retracement of its fall from November 2019, at 0.9500. However, an upward sloping trend line since March 09, near 0.9470 now, could restrict further downside.

In a case where the bears dominate past-0.9470, 0.9400 and 0.9320 will offer intermediate halts to the pair’s southward trajectory towards the monthly low around 0.9180.

Meanwhile, a daily closing beyond 50-day EMA level of 0.9650 needs to overcome 61.8% of Fibonacci retracement, close to 0.9700, ahead of confronting 200-day EMA figures surrounding 0.9800.

Should there be a clear run-up past-0.9800, November month highs close to 1.0023 may lure the bulls.

USD/CHF daily chart

Trend: Pullback expected