- Although the US dollar strengthened on the US CPI data, USD/CHF is still in the same familiar territory.

- The market participants will monitor inflation and any shifts in sentiment in favor of the SNB and ECB.

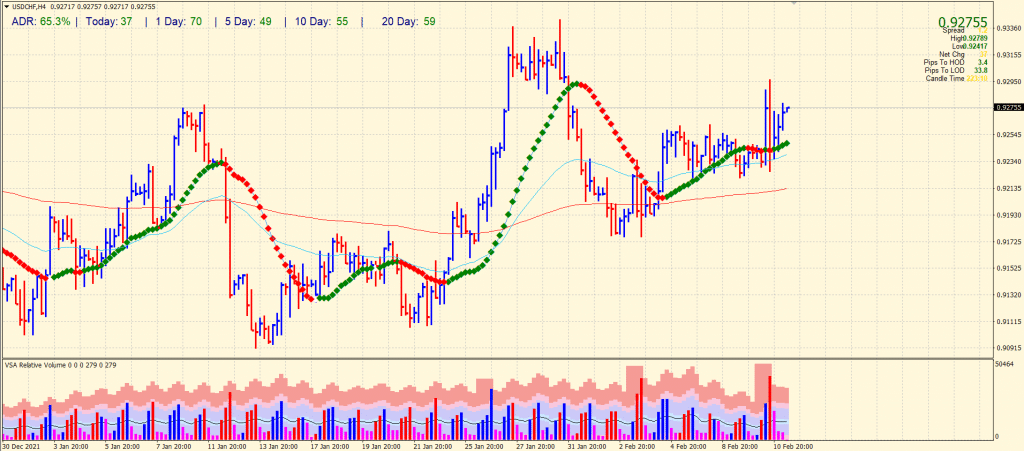

- Technically, the pair remains in a range and looking for a breakout.

The USD/CHF price analysis is bullish, marching higher towards 0.9300 and above. However, the price is still playing within the range.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

After alarming US inflation data, Wall Street is feeling risk-averse. However, the Federal Reserve’s James Bullard also bolstered the likelihood of a rate hike in March or even earlier, perhaps at a Federal Open Market Committee meeting.

Bond yields rose after Bullard said the data had made him “severely” hawkish, and he wants interest rates to rise a full percentage point by July 1. He even said the Fed could hike rates, so CME Group contracts trade with an 88% chance of at least a 50 basis point hike in March and a nearly 95% chance of at least a 100 basis point hike in June.

A similar reaction was seen in the stock markets, with the Dow Jones Industrial Average falling 1.47% and the S&P 500 falling 1.81%. Similarly, the Nasdaq Composite fell 2.1%. The broadest MSCI stock index outside of Japan dropped 0.76 percent. In spite of the holiday, Japanese markets could face macro inflation risks when they reopen on Monday.

Among the currencies least affected by the US data was the Swiss franc. Although traders assumed inflation risks were not limited to the US, medium-term inflation expectations are closely tied to Switzerland. In any case, CPI inflation remains below the Swiss National Bank’s target. Several other G10 countries face a similar situation. Additionally, long-term charts for USD/CHF show an uptrend. US dollar and USD/CHF are expected to remain supported by continued hawkish sentiment from the Fed.

However, Switzerland’s attractiveness as a safe haven may make it more attractive than geopolitical risks such as Russia if the ECB and the Fed diverge or converge. An increase in inflationary risks has led the ECB to open the door to a rate hike later in 2022. It profoundly impacted the foreign exchange market, lifting the Euro and putting a huge dent in the US Dollar. However, following less hawkish comments from the ECB governor the following Monday, the Euro lost its gains. Since the Swiss Franc and the Euro have the highest correlation among major currencies due to the close relationship between the Eurozone and Switzerland, traders will watch the ECB for any indications of monetary tightening in the Eurozone.

USD/CHF price technical analysis: Approaching 0.9300

The USD/CHF price remains above the key moving averages, just shy of yesterday’s highs near 0.9300. The average daily range for the pair is 65% ahead of the European session, indicating a highly volatile day. The price consolidates while the volume data gives no clue about any directional bias. Hence, the pair is expected to trade between 0.9200 to 0.9300.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money