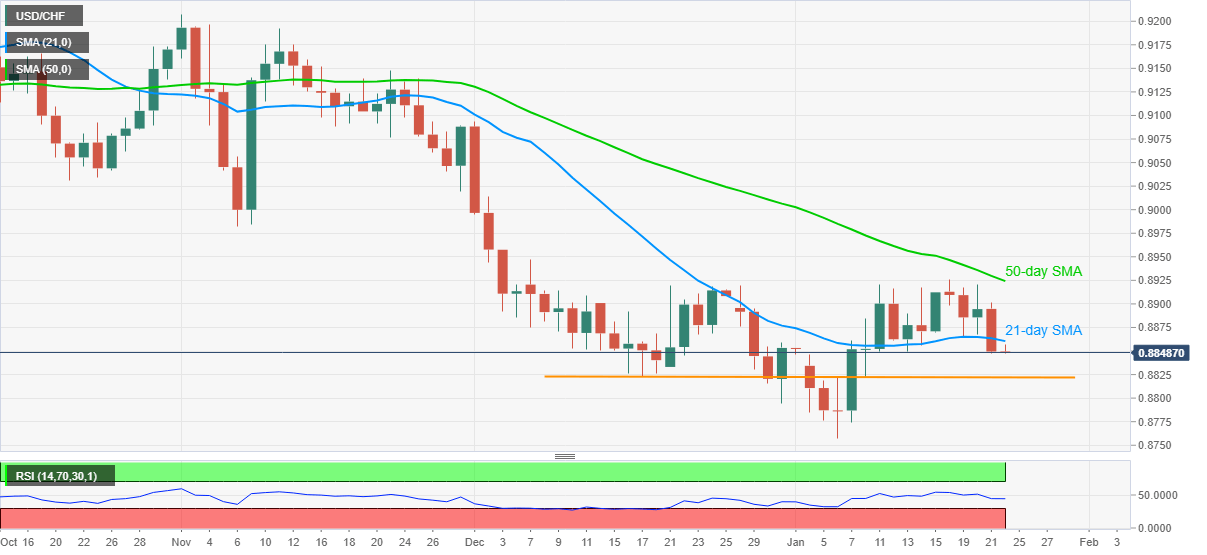

- USD/CHF sellers catch a breather after refreshing two week low.

- Downside break of 21-day SMA, descending RSI line favor sellers.

- 50-day SMA, monthly top offer a tough nut to crack for buyers.

Having recently dropped to the lowest since January 08, USD/CHF seesaws around 0.8850 during early Friday’s trading. The Swiss currency pair refreshed a multi-day low after breaking 21-day SMA. The downside move also takes support from receding RSI.

As a result, USD/CHF sellers seem to target a retest of the horizontal support comprising multiple levels since December 17, around 0.8820.

Although the pair’s weakness past-0.8820 becomes less likely, any further declines will not hesitate to break the 0.8800 while challenging the monthly low of 0.8857.

Alternatively, an upside clearance of 21-day SMA, at 0.8860 now, will aim for the 0.8900 round-figure ahead of challenging December’s top surrounding 0.8920.

However, a confluence of 50-day SMA and the monthly peak close to 0.8925-30 will be a strong resistance for the USD/CHF buyers to watch afterward.

USD/CHF daily chart

Trend: Further weakness expected