- USD/CHF gained strong positive traction on Thursday and jumped to near six-month tops.

- RSI on the daily chart is flashing overbought conditions and warrants some caution for bulls.

- Any meaningful pullback below the 0.9200 mark might now be seen as a buying opportunity.

The USD/CHF pair caught some aggressive bids during the European session and spiked to the highest level since late September 2020, around the 0.9230-35 region in the last hour.

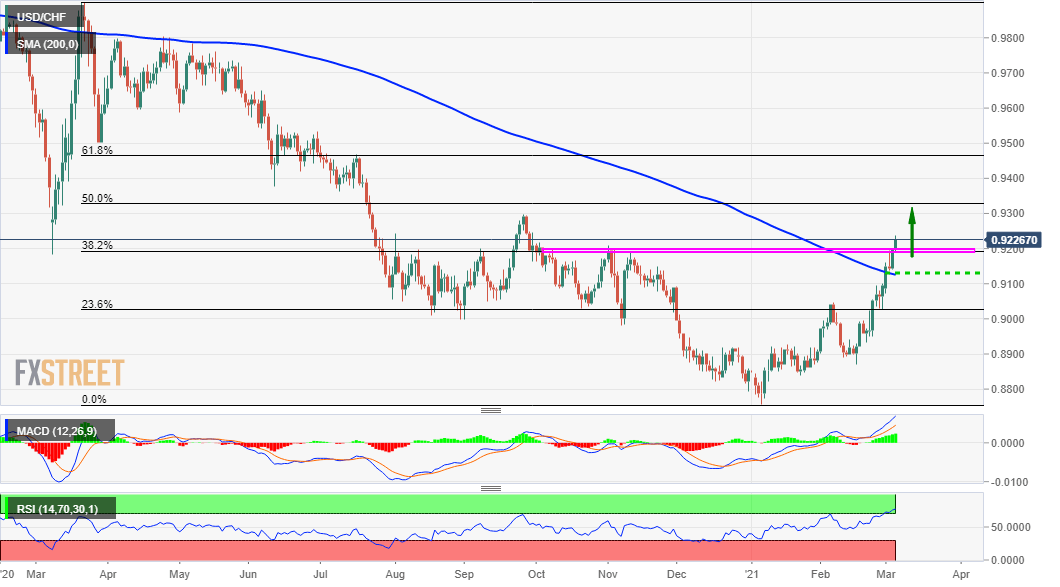

Given this week’s breakthrough the very important 200-day SMA, a sustained move beyond the 0.9200 mark was seen as a fresh trigger for bullish traders. The mentioned handle coincided with the 38.2% Fibonacci level of the 0.9902-0.8758 downfall and should now act as a key pivotal point for short-term traders.

Meanwhile, RSI on the daily chart is already flashing overbought conditions and warrants some caution for bullish traders. This, in turn, makes it prudent to wait for some near-term consolidation or a modest pullback towards the 0.9200 mark before positioning for an extension of the ongoing strong appreciating move.

The USD/CHF pair now seems all set to appreciate further and aim to test September 2020 swing highs, just ahead of the 0.9300 round-figure mark. Some follow-through buying should pave the way for a move towards challenging the 50% Fibo. level hurdle, around the 0.9340 region.

On the flip side, any meaningful pullback now seems to find decent support near the 0.9200 mark (38.2% Fibo. level). Further weakness below might still be seen as a buying opportunity. This, in turn, should help limit the downside near the 0.9140-30 region (200-DMA), which now seems to act as a strong base for the USD/CHF pair.

USD/CHF daily chart

Technical levels to watch