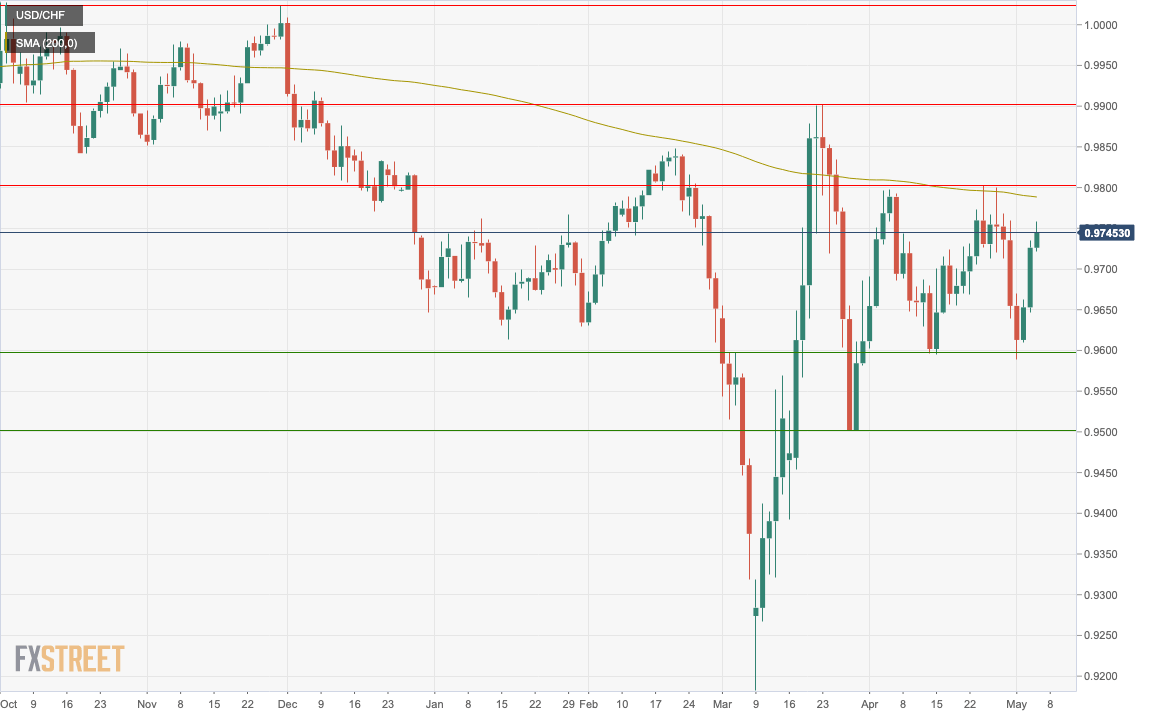

- The US dollar appreciates for the third consecutive day, approaching the range top at 0.9800.

- The pair might find important resistance at the 200-day SMA at 0.9700.

- Above 0.9700, the USD/CHF might aim towards 0.9900 on its way to parity.

The US has extended its rally for the third consecutive day on Wednesday, consolidating above 0.9700, to approach the top of the last six weeks’ trading range, at 0.9800 area. The daily chart shows the pair building up momentum above the 50 and 100-day SMA’s and approaching the 200-day SMA, currently at 0.9790, which has capped the pair over the last weeks.

The 0.9790/0.9800 range, only 30 pips above today’s intra-day high at 0.9758, is likely to offer strong resistance as there was where the USD was stopped on April 6, April 24 and April 28. A clear confirmation above here might increase bullish momentum on the pair to aim towards March’s high above 0.9900 on its way to the psychological 1.0000 level.

On the downside, the support level at 0.9595 is holding the pair’s current neutral stance on the daily chart. If that level is broken, bears might increase pressure, pushing the pair towards March 27 and 30 lows at 0.9503.