The USD/CHF price drops like a rock right now as the Dollar Index starts falling again. However, we have a strong positive correlation between these two, so DXY’s further decline should force the pair to reach fresh new lows in the short term.

–Are you interested to learn more about automated trading? Check our detailed guide-

The pressure is high ahead of the FOMC meeting. The Federal Reserve will publish its Federal Funds Rate tomorrow. The Fed is expected to maintain its monetary policy unchanged in tomorrow’s meeting. But any hint that they will take action in the coming meeting could bring sharp movement on all markets and not only on the USD/CHF.

Today, the US CB Consumer Confidence could bring more volatility on USD/CHF. Worse than expected, data could punish the USD.

DXY technical analysis

The DXY index plunged and now is traded outside of the rising wedge pattern. It’s pressing the weekly S1 (92.54) and the 78.6% retracement level. Also, the price is located below the down trendline signaling strong selling pressure.

Stabilizing under these support levels could confirm and could activate the reversal pattern. The further drop should force the USD to depreciate versus all its rivals.

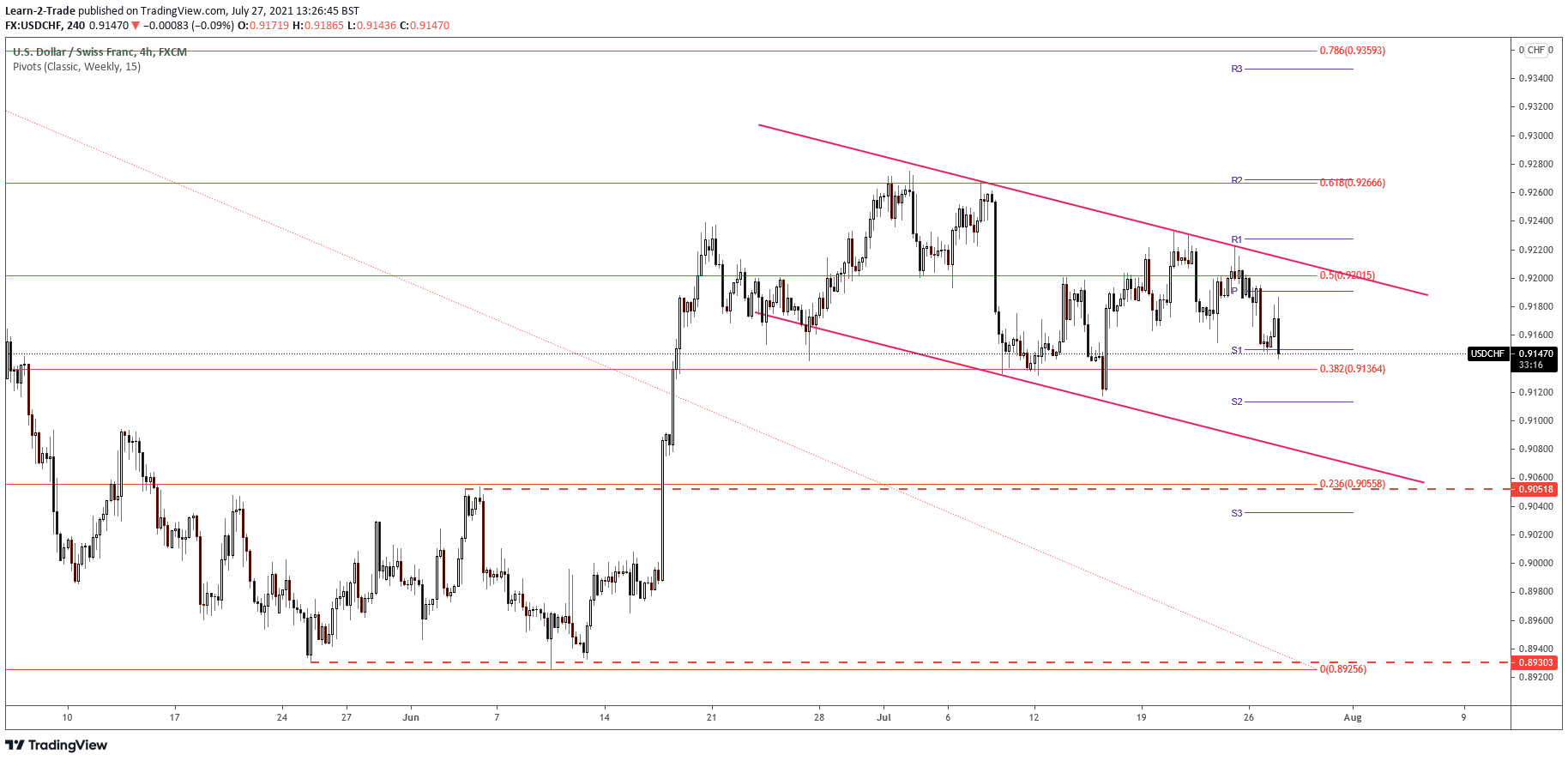

USD/CHF price technical analysis: Downtrend to prevail

The USD/CHF price goes down within a downtrend channel. It stands at 0.9146 below the weekly S1 (0.9149) level. The 38.2% (0.9136) retracement level is seen as the next downside target. Thus, the major downside target stands at the channel’s downside line.

The pair could resume its decline within the channel’s body as long as the DXY drops further in the short term. However, only an upside breakout above the downtrend line, down channel’s resistance, could signal that the corrective phase is over.

–Are you interested to learn more about forex signals? Check our detailed guide-

Also, staying above the 38.2% retracement level could bring us a new long signal sooner. The USD/CHF pair moves somehow sideways on the 4-hour chart. A false breakdown with great separation through the support level or a major bullish engulfing could signal new bullish momentum.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.