The USD/CHF price dropped aggressively as the DXY resumed its sell-off. It stands at 0.9058 after reaching the potential support level. Still, the selling pressure is high. So, the USD/CHF pair could drop further anytime.

–Are you interested to learn more about automated trading? Check our detailed guide-

As you already know, the Federal Reserve maintained its monetary policy unchanged in yesterday’s session. The USD buyers were disappointed. That’s why the USD has really activated its corrective phase.

The Dollar Index is trading at 91.88, far below 92.74 yesterday’s high. The index has validated a rising wedge pattern. So the current sell-off is natural. DXY’s further decline could force the Dollar to resume its depreciation.

Unfortunately, the USD has taken a hit today from the advance GDP, which has reported only a 6.5% growth versus 8,5% expected. Also, the unemployment claims dropped from 424K to 400K, failing to reach the 382K estimate.

USD/CHF price technical analysis: Where are bears heading?

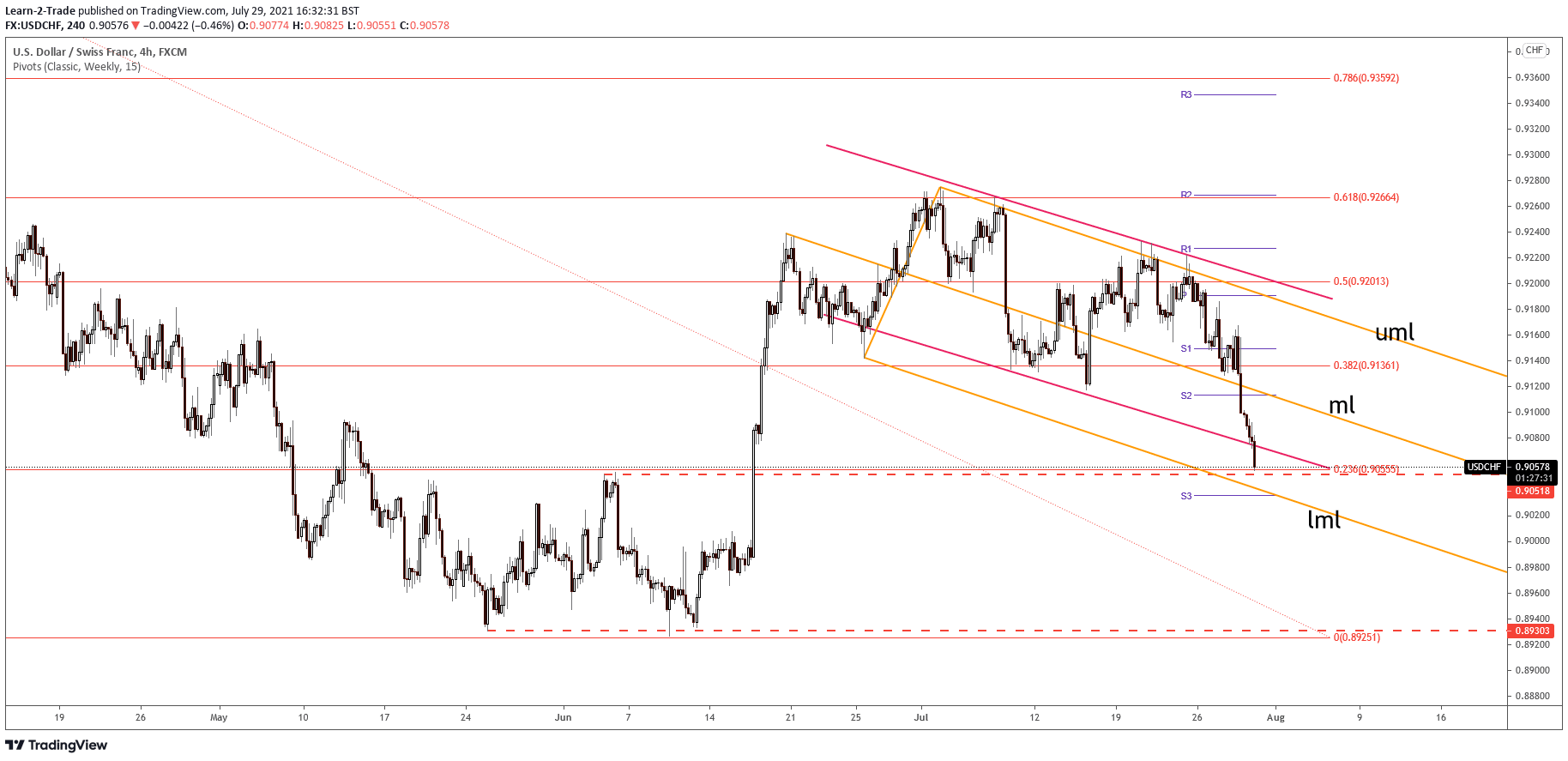

The USD/CHF pair plunged and is now challenging the 23.6% retracement level. In addition, it’s located under the downtrend channel’s support line. As you can see, USD/CHF has found strong resistance at the 61.8% retracement level and now it has dropped within the descending pitchfork’s body.

Technically, its failure to stay above the 38.2% retracement level signaled a deeper decline. However, the bias remains bearish as long as it stays under the downside and below the descending pitchfork’s median line (ml).

–Are you interested to learn more about forex signals? Check our detailed guide-

The lower median line (LML) and the S3 (0.9035) are potential downside targets. However, USD/CHF could find support on these levels. In the short term, we cannot exclude a temporary rebound after the current massive drop.

The Dollar Index could find temporary support soon. A potential bounce back should bring a throwback here as well. USD/CHF could resume its downside movement if it drops and closes under the immediate obstacles.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.