- The USD/CHF pair could print a larger drop if it makes a new lower low.

- The pair is trapped within a range pattern, so we’ll have to wait for a valid breakout from this formation.

- The US data has come in worse than expected, so the greenback could resume its depreciation.

The USD/CHF price dropped in the short term as the Dollar Index has extended its sell-off. However, we have a strong positive correlation between these two assets.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

The price stands at 0.9123 level and is almost to hit critical support levels. It remains to see how the pair will react right after the US data will be released.

The Chicago PMI was reported at 66.8 in August, below 68.0 estimates and versus 73.4 in July. This could be bad for the USD in the short term. In addition, the US HPI gained only by 1.6%, failing to reach 1.9% growth expected, while the S&P/CS Composite-20 HPI gained by 19.1%, beating the 18.7% growth forecasted.

Fundamentally, the pair could drop as the CB Consumer Confidence was reported lower at 113.8 in August versus 122.9 expected compared to 129.1 points reported in July. So, the US data have come in worse than expected. The Dollar Index could resume its sell-off after these figures.

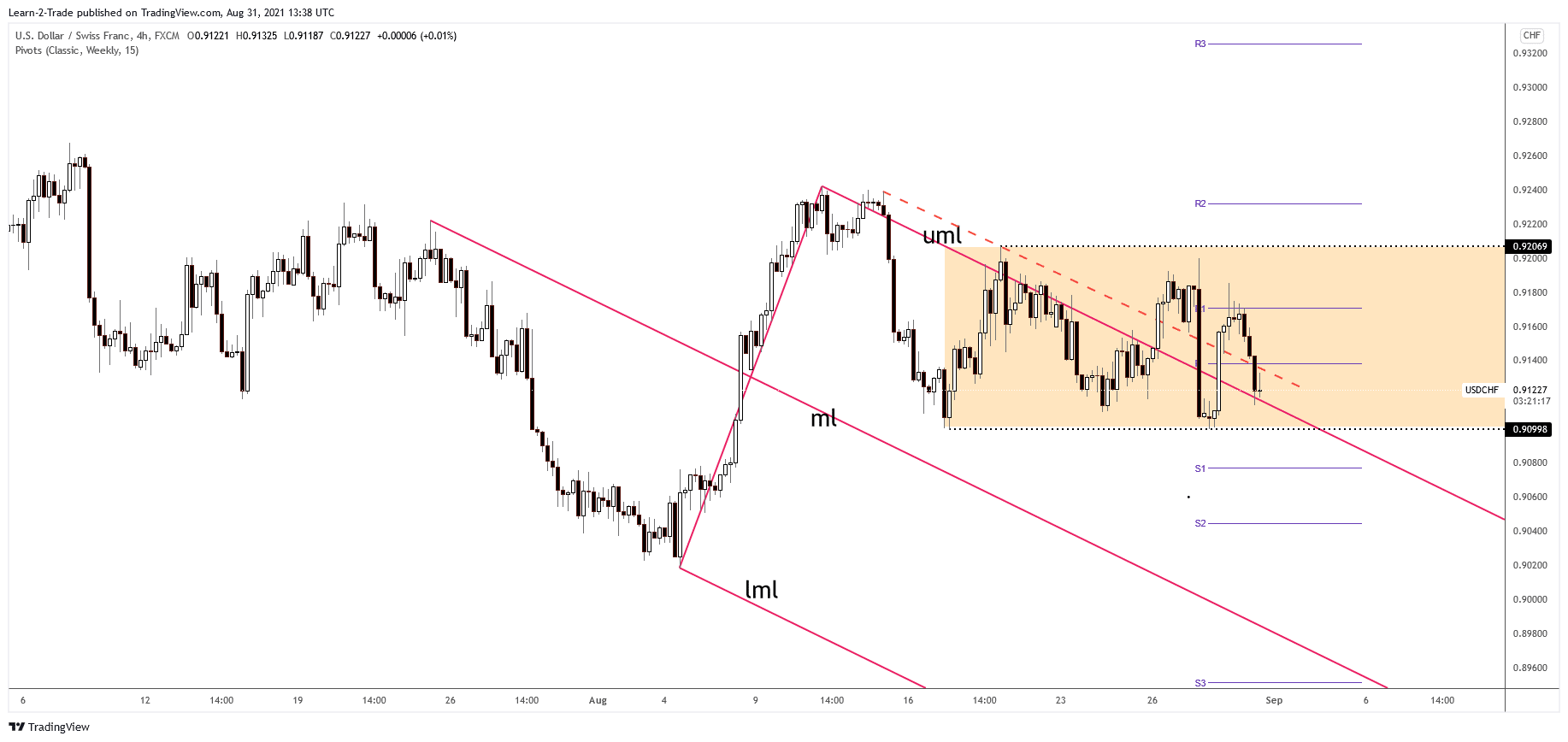

USD/CHF price technical analysis: Imminent downside breakout

The USD/CHF pair failed to come back towards 0.9206 former high, signaling strong selling pressure. It’s trapped within a range between 0.9206 and 0.9099 levels. A valid breakout from this pattern could bring fresh trading opportunities.

0.9099 is seen as crucial static support. A valid breakdown through this level indicates that the USD/CHF pair could develop a broader downside movement. Technically, the price was somehow expected to rise after escaping from the descending pitchfork’s body. But unfortunately, it has failed to make a new higher high which would have signaled an upside continuation.

–Are you interested to learn more about making money in forex? Check our detailed guide-

Coming back within the descending pitchfork’s body and stabilizing below the 0.9099 former low could indicate a potential sell-off towards the weekly S2 (0.9044) or even lower towards 0.9 psychological level. However, the downside scenario could be invalidated by false breakdowns through the immediate support levels. Also, a bullish pattern printed on the upper median line (UML) of the 0.9099 static support could signal a rebound.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.