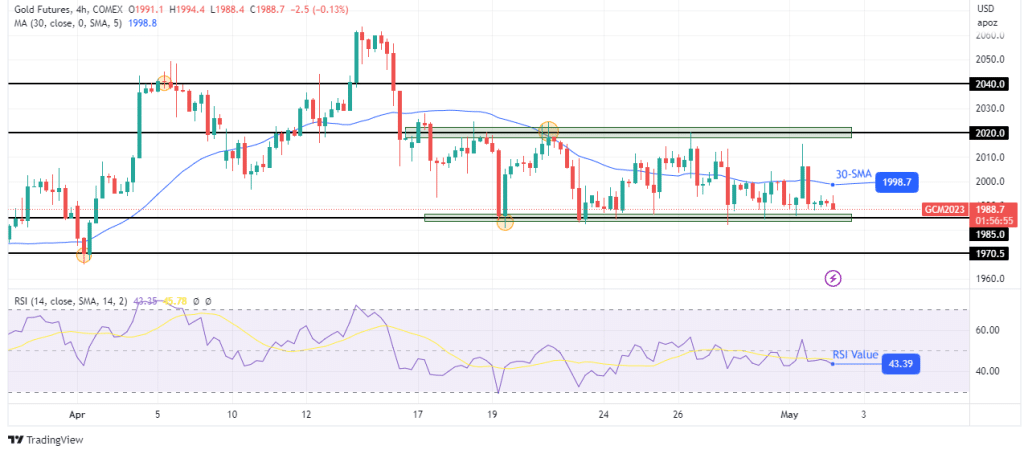

- The false breakdowns below the lower median line (LML) signaled further growth.

- The US data could be decisive these days.

- A valid breakout through the median line confirms a larger growth.

The USD/CHF price rallied on Tuesday, trading at 0.8990 at the time of writing. The greenback dominates the currency market as the Dollar Index has extended its rebound.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

DXY’s further growth should force the USD to appreciate it versus all its rivals. Fundamentally, the US Dollar received a helping hand from the US ISM Manufacturing PMI, ISM Manufacturing Prices, and Construction Spending data.

The economic indicators came in better than expected in the last trading session. Today, the Swiss Franc took a serious hit from the Switzerland data. The Manufacturing PMI was reported at 45.3 points versus 47.2 points expected and compared to 47.0 points in the previous reporting period. SECO Consumer Climate came in at -30 points compared to the -22 points expected.

Later, the JOLTS Job Openings represent a high-impact event and are expected at 9.74M versus 9.93M in the previous reporting period.

In addition, Factory Orders should report a 1.3% growth after the 0.7% drop registered in the previous reporting period, while Wards Total Vehicle Sales could jump from 14.8M to 15.1M.

The fundamentals should be decisive tomorrow as the FOMC, ISM Services PMI, and ADP Non-Farm Employment Change represent major events.

USD/CHF price technical analysis: Strongly bullish bias

As you can see on the hourly chart, the USD/CHF pair tested and retested the ascending pitchfork’s lower median line (LML), confirming it as a strong dynamic support. It has registered only false breakdowns confirming further strong buyers and further growth.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

The pair has reached the weekly R1 of 0.9000, a static resistance. Technically, after confirming the ascending pitchfork, the median line (ml) could attract the currency pair. The median line (ml) acts as a magnet. A larger growth should be activated after a valid breakout through this dynamic resistance. This scenario could announce further growth towards the upper median line (uml).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.