- USD/CHF could move higher towards the upper median line (UML) if it stabilizes above 38.2%.

- A larger growth could be validated by a valid breakout from the descending pitchfork’s body.

- DXY’s further growth should help the greenback to resume its appreciation.

The USD/CHF price rallies as the Dollar Index has jumped higher even if the US retail sales data have come in worse than expected. The DXY has found strong support and now is almost to reach the 93.19 static resistance.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The US Retail Sales dropped by 1.1% in July, more than 0.2% expected and after 0.7% growth in June. Moreover, the Core Retail Sales dropped by 0.4%, even though the analysts had expected a 0.2% growth in July after 1.6% growth in June.

Fundamentally, the USD was saved by the Industrial Production, which has increased by 0.9% versus 0.5% expected. The indicator has increased surprisingly by the Capacity Utilization Rate from 75.4% to 76.1%, exceeding the 75.7% estimate. The Business Inventories indicator was reported in line with expectations.

USD/CHF price technical analysis: 0.91 to lend support

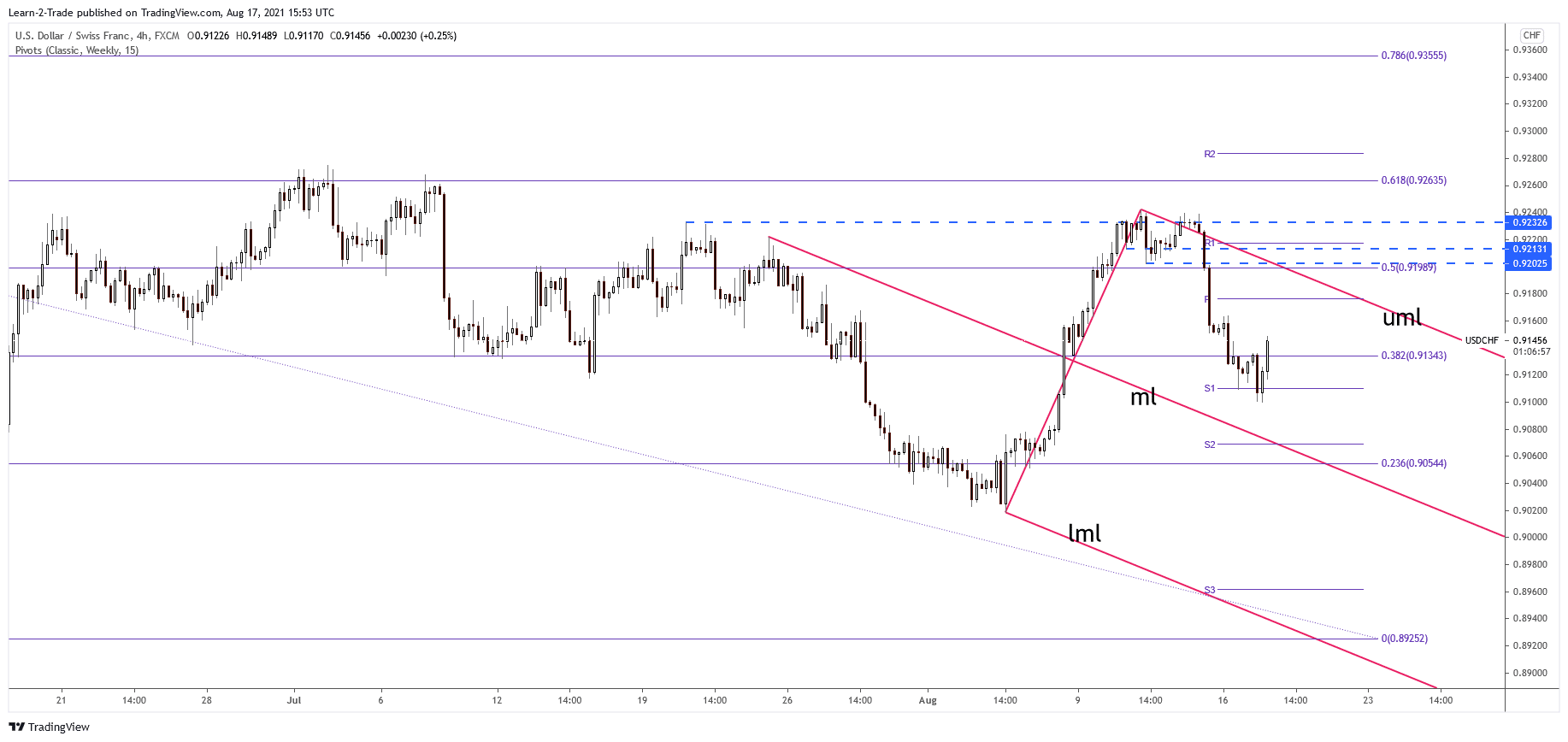

The USD/CHF pair has found support right below the weekly S1 (0.9110), failing to approach and reach the descending pitchfork’s median line (ml). It’s located at 0.9142 above the 38.2% (0.9134) retracement level.

Stabilizing above this level could signal potential growth towards the descending pitchfork’s upper median line (UML). However, the pressure is still high in the short term as long as it stays within the descending pitchfork’s body.

Only a valid breakout above the upper median line (UML) may really signal an upside continuation. Technically, the median line (ml) and the 23.6% retracement level are seen as major near-term support levels.

–Are you interested to learn more about forex signals? Check our detailed guide-

The USD/CHF pair moves somehow sideways on the H4 chart, so we’ll have to wait for a fresh trading opportunity. However, the downside seems limited after registering only a false breakdown below the weekly S1 (0.9110).

The pair could extend its drop only if it stabilizes below 38.2% and makes a new lower low.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.