“¢ The post-US CPI USD selling remains unabated and keeps exerting downward pressure.

“¢ A modest pickup in the US bond yields/risk-on mood does little to lend any support.

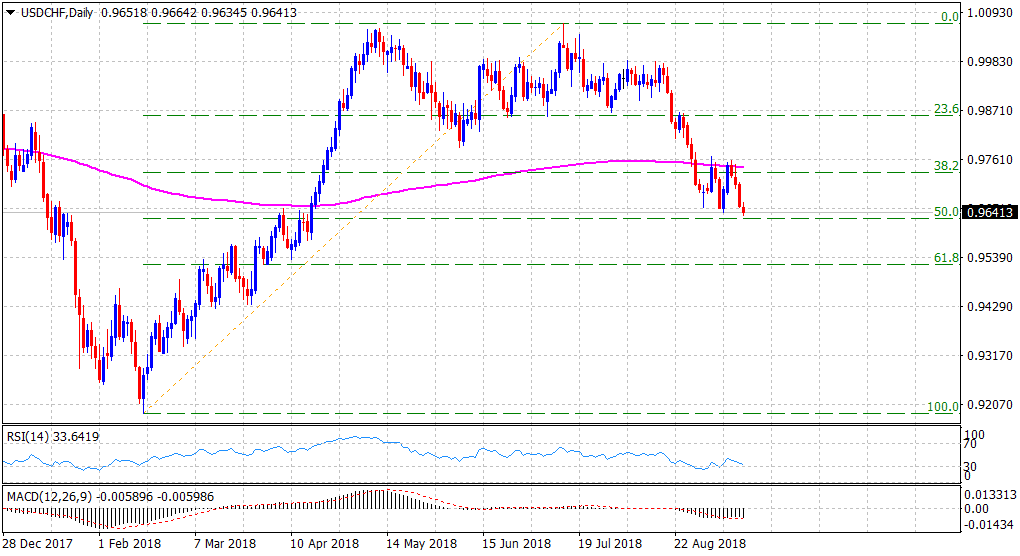

“¢ Fresh technical selling to emerge on a sustained break below 61.8% Fibo. level.

After an initial uptick to 0.9664, the USD/CHF pair met with some fresh supply and dropped to near five-month lows in the last hour.

The pair extended this week’s rejection slide from the very important 200-day SMA and kept losing ground for the fourth consecutive session. The prevalent weaker tone surrounding the US Dollar, which seemed largely unaffected by a modest uptick in the US Treasury bond yields, was seen as one of the key factors exerting downward pressure.

Thursday’s lower-than-expected US consumer inflation figures changed views on an acceleration in domestic inflation and forced investors to scale back faster Fed rate hike expectations, which kept the USD bulls on the defensive through the early European session on the last trading day of the week.

Meanwhile, a continuous improvement in risk sentiment, as depicted by a positive opening across European bourses and which tends to dent the Swiss Franc’s safe-haven appeal, did little to lend any support and stall the pair’s slide to the lowest level since April 17.

Further downside, however, is likely to remain limited as market participants now look forward to the release of important US macro data – August monthly retail sales data, which along with the prelim UoM consumer sentiment index might provide some fresh trading impetus.

Technical Analysis

Earlier this week, the pair failed to move back above the 200-day SMA and once again met with some fresh supply near the 0.9760-65 region, indicating increasing selling bias on every attempted recovery move.

A subsequent fall to 61.8% Fibonacci retracement level of the 0.9188-1.0068 adds credence to the bearish outlook and thus, increases prospects for an extension of the ongoing downfall.

However, it would be prudent to wait for a convincing break through the mentioned support before positioning for any further near-term depreciating move.