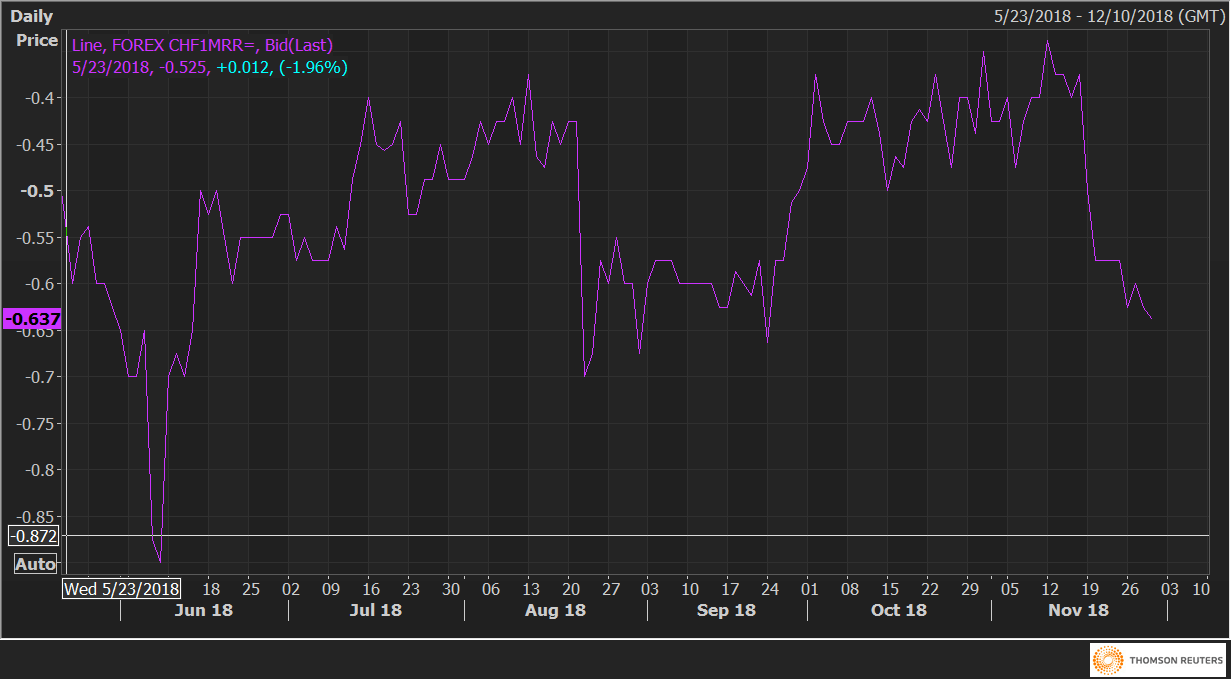

The USD/CHF one-month 25 delta risk reversals (CHF1MRR) are currently trading at -0.673 in favor of put options – the level last seen on Sept. 24.

Notably, the risk reversals stood at -0.338 on Nov. 12, which means the implied volatility premium (or the demand) for put options has increased sharply in the last 2.5-weeks.

The data indicates the investors are adding bets to position for further weakness in the USD/CHF pair, which is currently trading at 0.9959 – down 1.67 percent from the high of 1.01285 seen on Nov. 13.

*Negative risk reversals indicate the implied volatility premium for put options is higher than that for calls.

CHF1MRR