- USD/CHF has been trading sideways for most of the day on Monday within a tight 0.8900-0.8920 range.

- Amid early Asia Pacific session USD strength, the pair made a few attempts at breaking the 0.8920 level, but broadly failed.

USD/CHF has been trading sideways for most of the day on Monday within a tight 0.8900-0.8920 range, amid quiet and low volume trading conditions on account of the absence of US market participants, who are away for MLK Day.

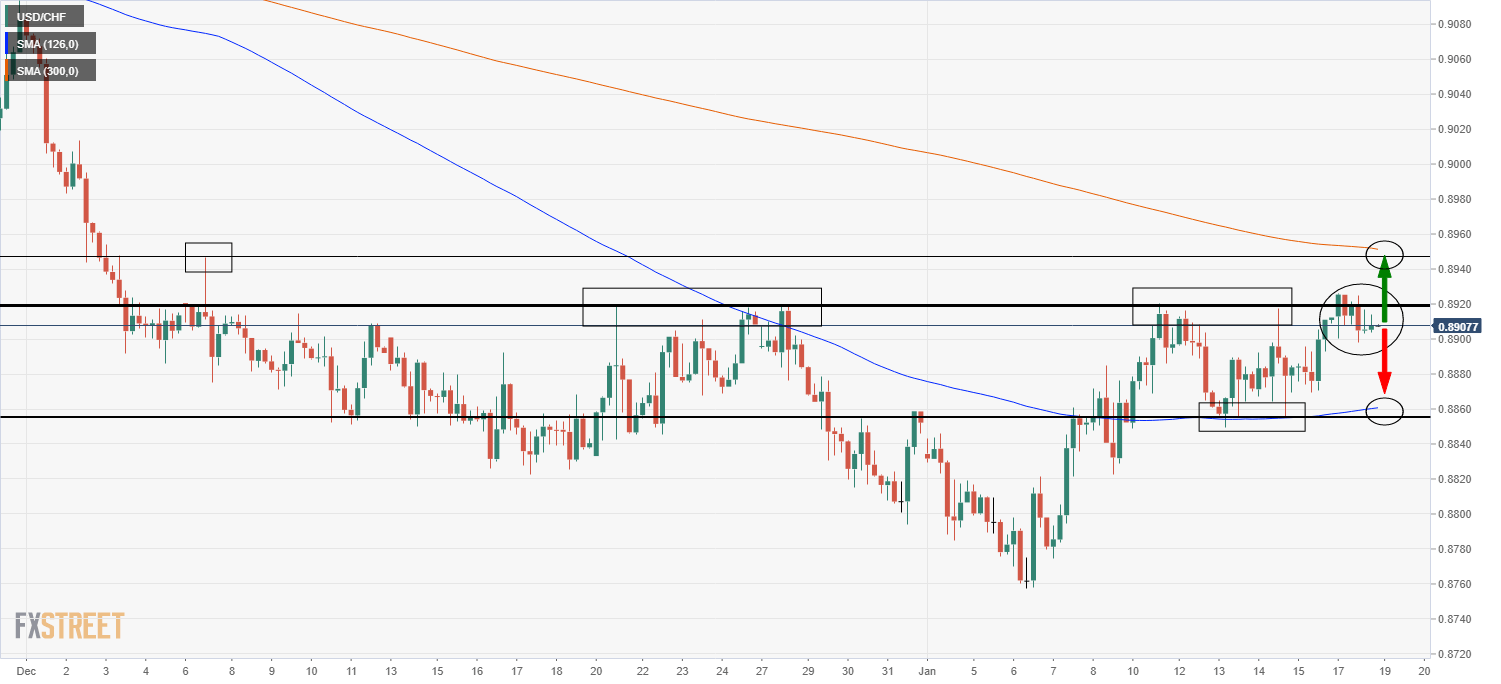

Amid early Asia Pacific session USD strength, the pair made a few attempts at breaking the 0.8920 level, an area which has capped the price action since early December, though to no avail. Markets are likely to find more directly upon the return of US players to the market on Tuesday following their long weekend, after which time FX pairs will be much more likely to break out of recent ranges.

Until then, 0.8920 remains the level of resistance to watch for USD/CHF. A break above this level would open the door to an extension upwards to the pair’s 50-day moving average at just above 0.8950. Failure could see the pair grind back down to the south towards last week’s lows which coincided with the 21-day moving average in the 0.8850s. If the Dollar Index continues to advance and manages to break above 91.00, then USD/CHF is looking at the upside of these two potential scenarios.

Driving the week

Key events for USD traders to watch this week predominantly revolve around US politics; former Fed Chair and US Secretary of the Treasury Janet Yellen testifies to the US Congress on Tuesday. Much of her prepared remarks have already been released; Yellen is set to declare that it is time to “act big” regarding fiscal stimulus to aid with the recovery given that government borrowing costs are so low. Absent more economic aid, Yellen says she sees the risk of a longer, more painful recession.

Moreover, Yellen is expected to clarify the US government’s position on the US dollar; she is expected to make it clear that the US will not seek to purposely weaken the US dollar. According to the Wall Street Journal, Yellen will say that “the value of the U.S. dollar and other currencies should be determined by markets. Markets adjust to reflect variations in economic performance and generally facilitate adjustments in the global economy” if asked about the incoming administration’s dollar policy.

Any departure from such a policy could trigger some volatility in USD and in precious metals markets. However, calls for a weaker USD does not mean getting a weaker USD; outgoing US President Donald Trump spent much of the last four years calling for a weak USD to help US exporters but failed to get until right at the end of his term, and that was only to do with the Fed’s actions to combat the pandemic. His protectionist trade policies and fondness of fiscal stimulus were seen as a USD positive combination at the time.

Bank of Singapore analyst Moh Siong Sim notes that Yellen “is kind of signaling a hands-off approach, which is reverting to what had traditionally been the case before Trump… I think the dollar and financial markets will be less of a focus, in terms of verbal rhetoric, for the Treasury secretary and the key focus will be getting policy implemented in terms of fiscal relief”.

Biden’s inauguration, which takes place on Thursday, will be scrutinised for any more commentary on fiscal stimulus, with doubts growing that the incoming President will be able to deliver the whole $1.9T promised package. Any hints of violence might also cause some jitters, as the violence on Capital Hill did earlier in the month, though, with security forces much better prepared this time around, things are expected to go smoothly.

More broadly, risk appetite, what happens with US bond yields (if they continue to rise this could be USD positive) and surprise negative events in the EU, like an Italian election, will all affect USD/CHF (with the latter to benefit European safe haven CHF).

USD/CHF four hour chart