- USD/CHF’s recovery from 0.9693 heads to immediate resistance-confluence.

- An upside break can trigger the pair’s rise to 200-HMA.

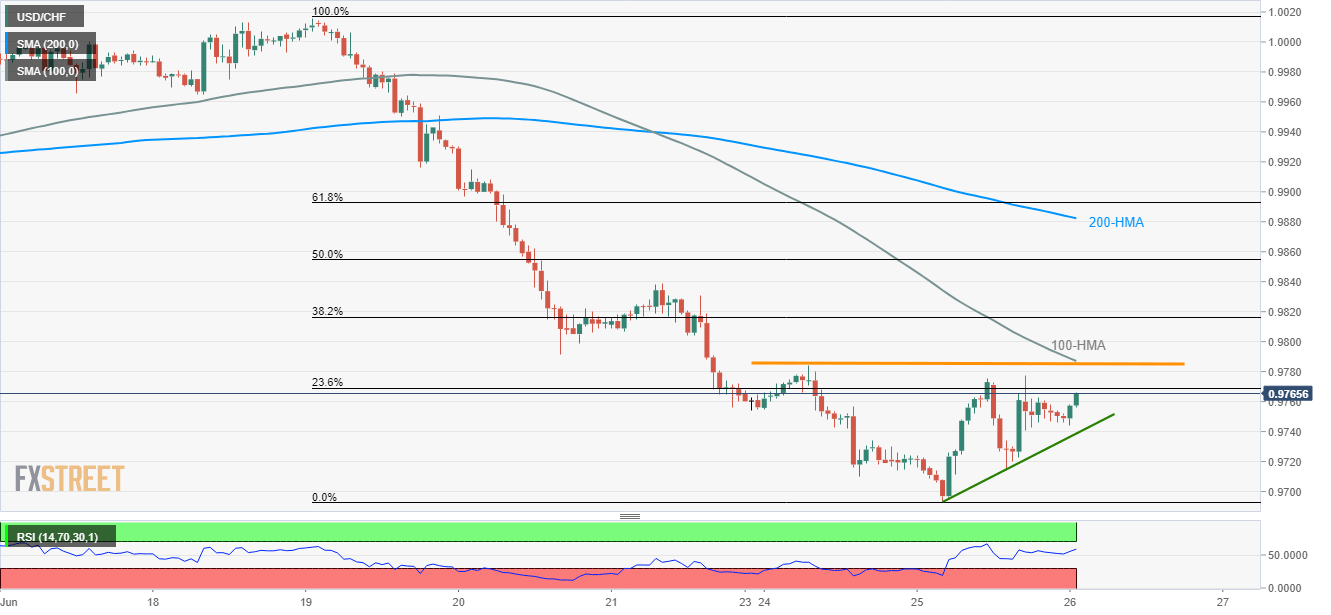

The USD/CHF pair’s recent pullback currently heads towards short-term key resistance-confluence as it trades near 0.9765 during early Wednesday.

The 100-hour moving average (HMA) and June 24 high near 0.9784/87 seems the strong upside resistance that holds the key to the quote’s run-up to June 21 top close to 0.9840.

Should there be additional increase past-0.9840, 200-HMA level of 0.9883 can lure the buyers.

On the downside, an upward sloping trend-line connecting lows since yesterday offers the closest support around 0.9740, a break of which can recall month’s low of 0.9693.

Gradually rising 14-bar relative strength index (RSI) highlights the upside momentum but nearness to overbought levels could confine the pair’s advances beyond the key resistance.

USD/CHF hourly chart

Trend: Pullback expected