- USD/CHF extends declines on the break of one-week-old support-line (now resistance).

- Sellers look for key technical levels amid bearish signals from MACD.

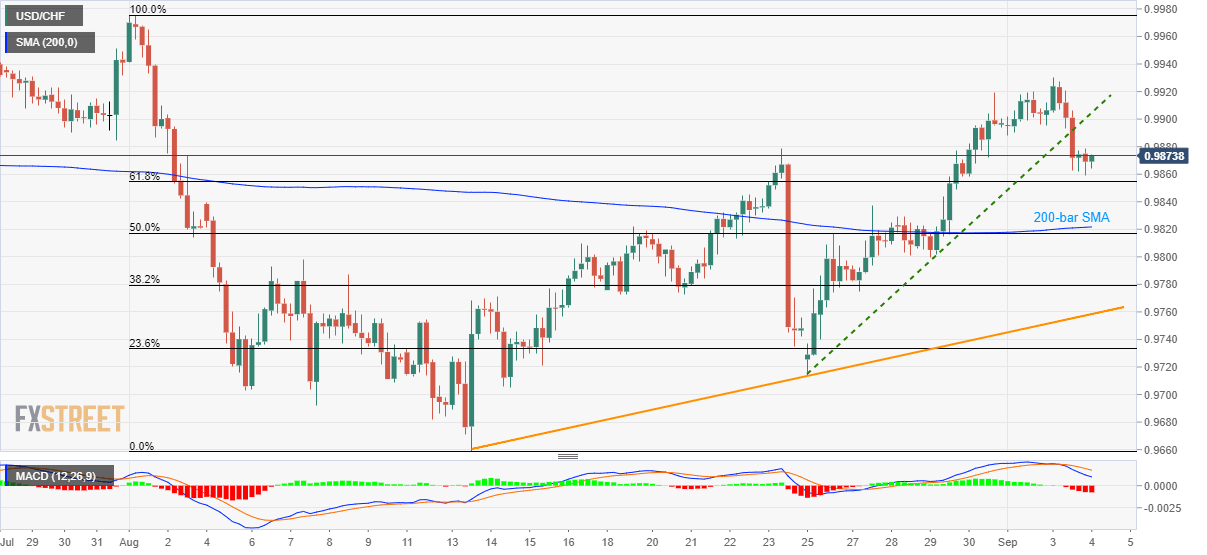

Following its break of immediate support-line, the USD/CHF pair remains on the back foot while taking rounds to 0.9870 amid Wednesday’s Asian session.

Sellers now aim for 61.8% Fibonacci retracement level of August month downpour, at 0.9854, as immediate support ahead of targeting 0.9822/17 confluence including 200-bar simple moving average (SMA) and 50% Fibonacci retracement level.

In a case prices slip beneath 0.9817, 38.2% Fibonacci retracement of 0.9780 may offer an intermediate halt to the south-run towards three-week-long rising trend-line close to 0.9760.

Adding to the sellers’ favor is a bearish signal from the 12-bar moving average convergence and divergence (MACD) indicator.

Alternatively, Monday’s low near 0.9890 and Tuesday’s top surrounding 0.9930 can offer immediate resistance to the pair, a break of which can escalate the run-up towards August month high surrounding 0.9980.

USD/CHF 4-hour chart

Trend: pullback expected