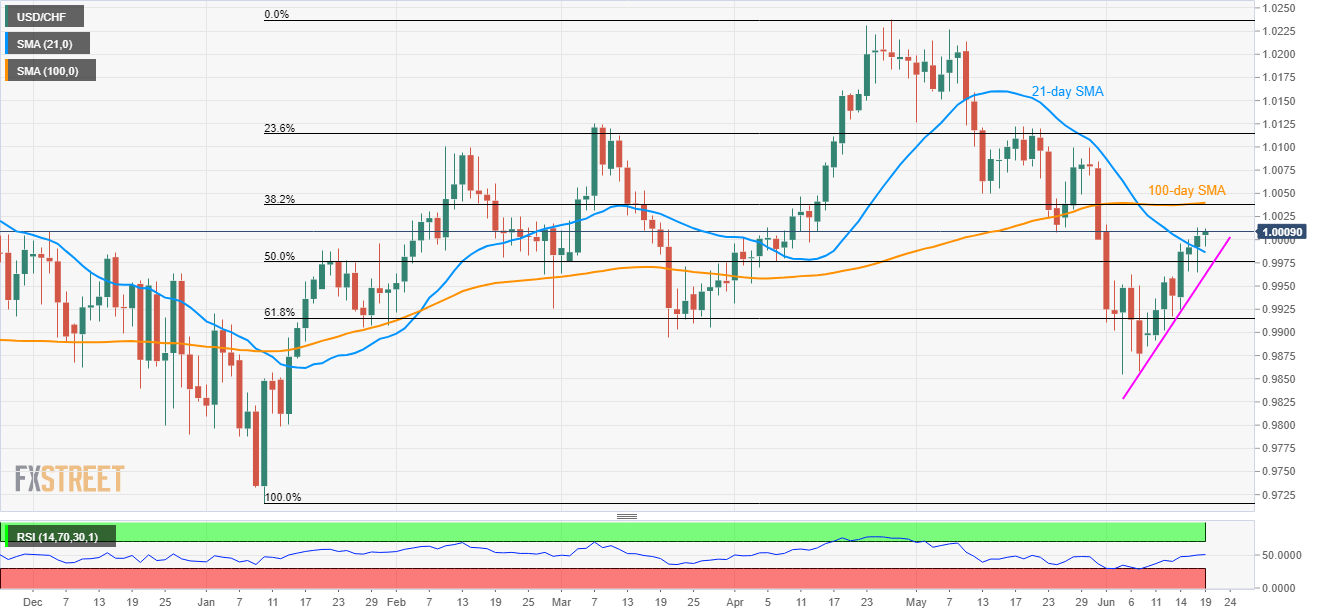

- A successful break of 21-day SMA favors further upside to near-term resistance-confluence.

- Immediate ascending trendline could follow on the downside break of 21-DMA.

USD/CHF’s sustained trading beyond 21-DMA now enables the buyers to take the bids near 1.0010 during the early Asian session on Wednesday.

Next in the buyers’ radar will be 1.0035/40 resistance confluence comprising 100-day simple moving average (SMA) and 38.2% Fibonacci retracement of its January to April upside.

In a case where prices rally past-1.0040, 1.0100 and 1.0130 could come back on the chart.

Meanwhile, a downside break of 21-day SMA (DMA) level of 0.9986 can fetch the quote short-term support-line at 0.9963 now, a break of which may take a rest on 61.8% Fibonacci retracement level of 0.9915 ahead of visiting 0.9900 round-figure.

Should be extended south-run below 0.9900, current month low near 0.9860 and mid-January bottoms around 0.9800 might become bears’ favorites.

USD/CHF daily chart

Trend: Bullish