- The USD/CHF pair extended the overnight sharp pullback from six-week tops and remained under some selling pressure for the second consecutive session on Friday.

- The pair dropped to fresh weekly lows, albeit now seems to have found some support near a previous descending trend-line resistance breakpoint – around mid-0.9800s.

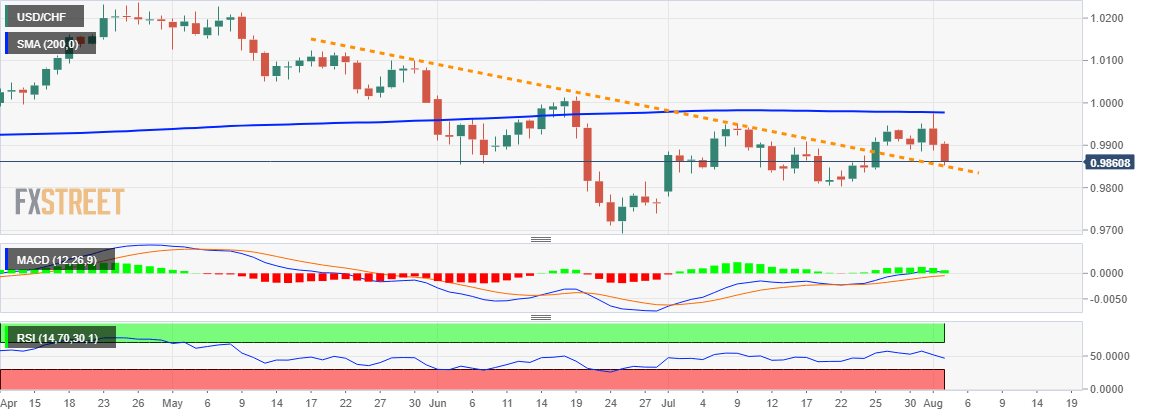

- Given the overnight slump, a subsequent weakness below 200-hour SMA was seen as a key trigger for bearish traders and a follow-through slide on the last day of the week.

The global flight to safety, amid resurfacing trade-war fears, underpinned demand for traditional safe-haven currencies – including the Swiss Franc and turned out to be one of the key factors exerting pressure on the major.

Failure to defend the mentioned resistance turned support will set the stage for an extension of the ongoing downfall and accelerate the slide further towards testing sub-0.9800 level – the 0.9785-80 horizontal support.

On the flip side, the 0.9900 handle now becomes immediate resistance, above which the pair is likely to head back the 0.9940 supply zone before eventually darting towards challenging the very important 200-day SMA – around the 0.9975 region. A follow-through buying will negate any negative bias and pave the way for a further near-term appreciating move towards reclaiming the parity mark.

USD/CHF daily chart