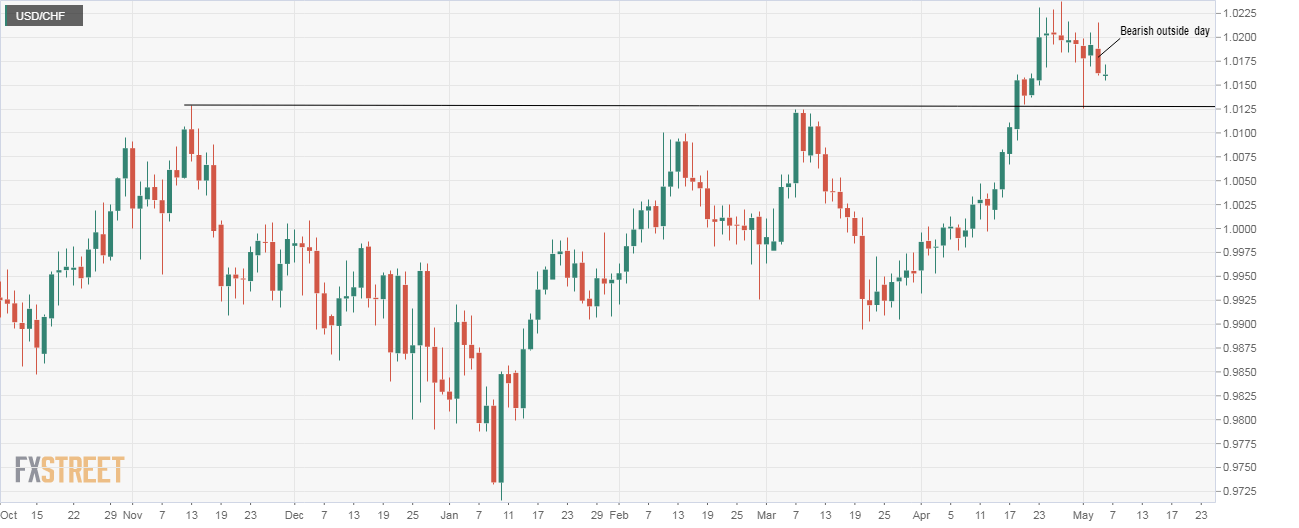

USD/CHF is looking south with risk aversion strengthening the case for a drop to 1.01285 (November high), as suggested by Friday’s bearish outside day candle.

Trump said Sunday that tariffs on $200 billion worth of Chinese goods will increase to 25% on Friday from the current 10%, reviving trade war fears. The risk assets are currently flashing red with the futures on the S&P 500 currently down 57 points or 1.95%.

As a result, the safe haven Swiss Franc (CHF) could pick up a strong bid in the European session, pushing the USD/CHF pair down to the former resistance-turned-support of 1.01285.

The technical studies are also biased bearish. For instance, the pair carved out a bearish outside day on Friday – a candlestick pattern widely considered a sign of bullish-to-bearish trend change. Further, the 14-day relative strength index (RSI) has rolled over from the overbought territory (above 70.00), signaling scope for a drop in the USD/CNH pair.

Daily chart

Trend: Bearish

Pivot points