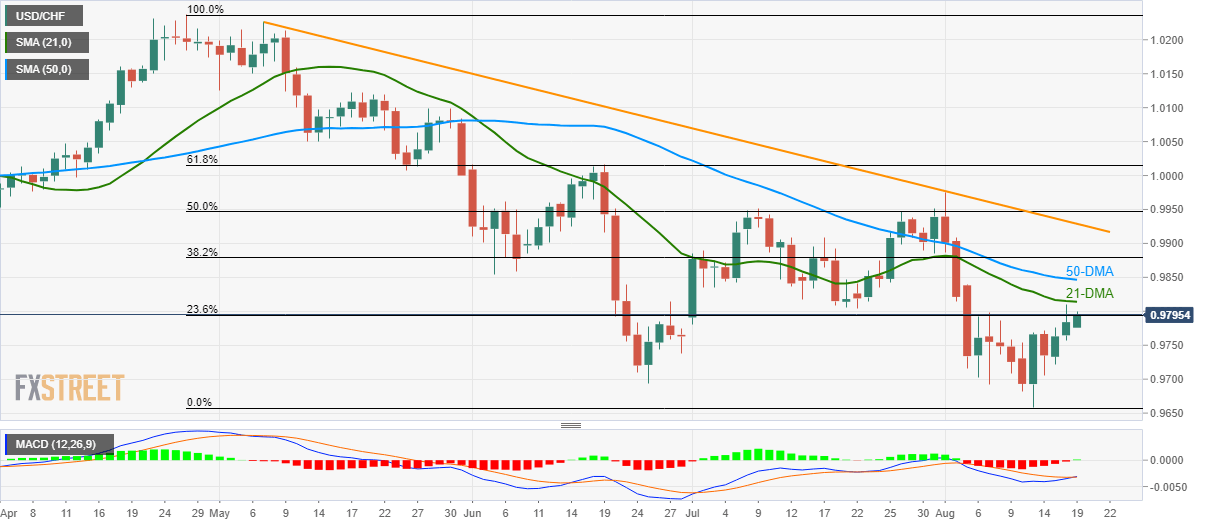

- USD/CHF again confronts 23.6% Fibonacci retracement, while aiming 21-DMA, with the bullish MACD.

- 50-DMA and 38.2% Fibonacci retracement can please buyers before three-month-old resistance-line comes into play.

Although 23.6% Fibonacci retracement of April-August downpour has repeatedly questioned USD/CHF upside, bullish MACD increases the odds for the pair’s breakout as it takes the rounds to 0.9796 heading into the European session open on Monday.

In doing to 21-day simple moving average (DMA) at 0.9815, followed by 50-DMA level of 0.9846, will become buyers’ next targets. However, 38.2% Fibonacci retracement level of 0.9880 and a downward sloping trend-line since early-May, at 0.9930, could challenge bulls then after.

Should traders ignore bullish signal by 12-bar moving average convergence and divergence (MACD) indicator, 0.9770 and 0.9715 hold the keys for the pair’s drop to 0.9660.

Additionally, pair’s extended south-run beneath 0.9660 might not hesitate to call 0.9600 back to the chart.

USD/CHF daily chart

Trend: On the recovery mode