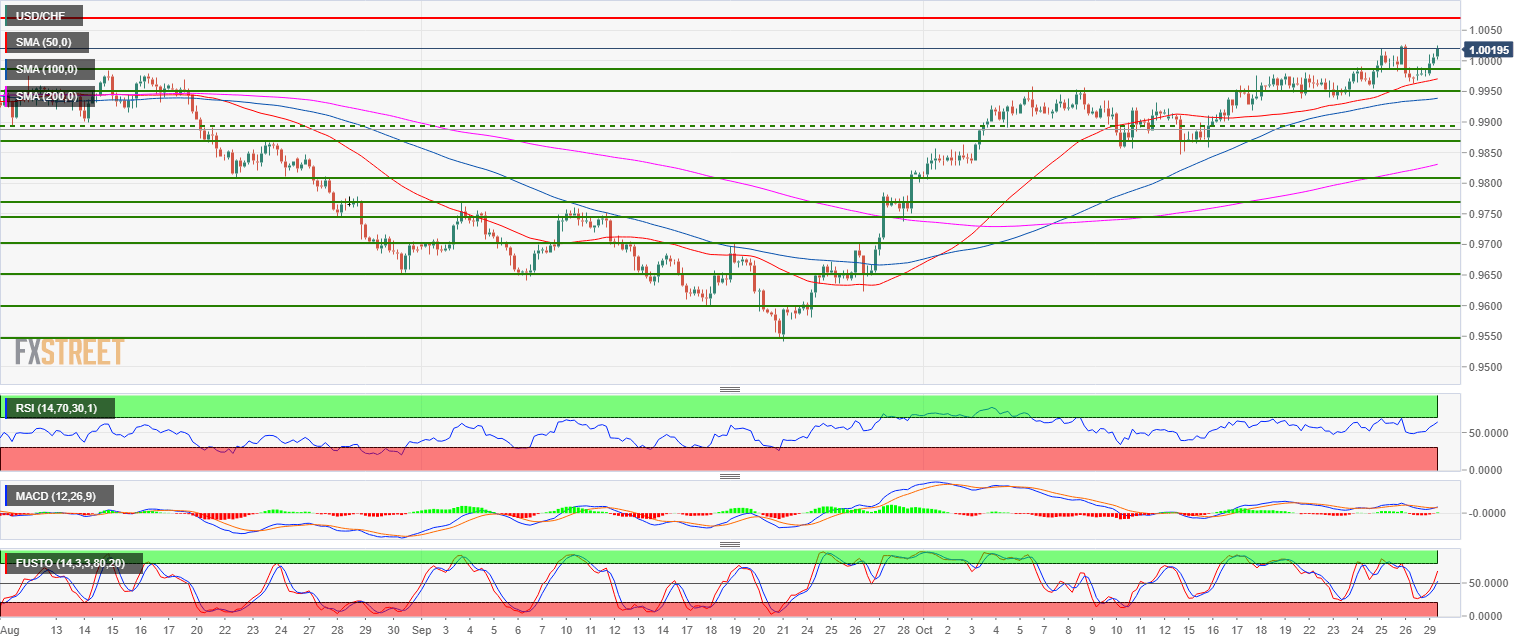

- USD/CHF is in a bull trend above the 200-period simple moving average on the 4-hour chart.

- USD/CHF broke above the parity level and look set to close the day above it. The nest target is likely located near 1.0068 July 13 high.

- Below the parity level supports to the downside are likely located near 0.9950 and 0.9891 October 4 low.

USD/CHF 4-hour chart

Main trend: Bullish

Resistance 1: 1.0068 July 13 high

Resistance 2: 1.0100 figure

Resistance 3: 1.0160 March 2017 high

Support 1: 1.0000 parity level

Support 2: 0.9986 August high

Support 3: 0.9950 figure

Support 4: 0.9891 October 4 low

Support 5: 0.9868 July 31 low

Additional key levels at a glance

USD/CHF

Overview:

Last Price: 1.0023

Daily change: 51 pips

Daily change: 0.511%

Daily Open: 0.9972

Trends:

Daily SMA20: 0.9925

Daily SMA50: 0.9803

Daily SMA100: 0.987

Daily SMA200: 0.9748

Levels:

Daily High: 1.0028

Daily Low: 0.9964

Weekly High: 1.0028

Weekly Low: 0.9938

Monthly High: 0.982

Monthly Low: 0.9542

Daily Fibonacci 38.2%: 0.9988

Daily Fibonacci 61.8%: 1.0003

Daily Pivot Point S1: 0.9948

Daily Pivot Point S2: 0.9924

Daily Pivot Point S3: 0.9884

Daily Pivot Point R1: 1.0012

Daily Pivot Point R2: 1.0052

Daily Pivot Point R3: 1.0076