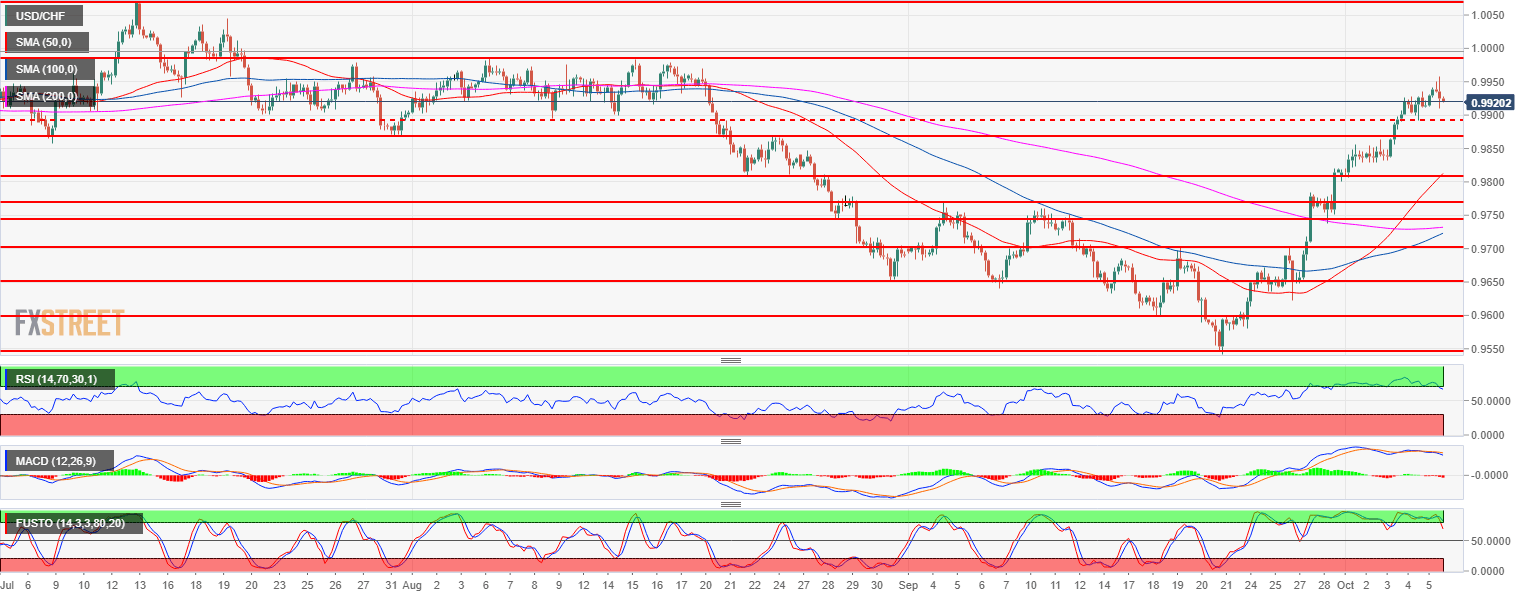

- USD/CHF is in a bull trend as the bulls broke above the 100-day simple moving average (DMA) on the daily time-frame (not shown).

- USD/CHF is finding some resistance and is having trouble to move beyond 0.9950 as the week is about to come to an end. The pair has been on a strong bull run with the RSI and Stochastics indicators being in overbought conditions for more than a week. The MACD crossover is also suggesting that a small pullback can be on the cards for USD/CHF.

- The 0.9891 level (October 4 low) and 0.9868 (July 31 low) should act as levels of support on a pullback.

Spot rate: 0.9920

Relative change: 0.03%

High: 0.9958

Low: 0.9909

Main trend: Bullish

Resistance 1: 0.9984 August 15 high

Resistance 2: 1.0000 parity level

Resistance 3: 1.0068 July 13 high

Support 1: 0.9891 October 4 low

Support 2: 0.9868 July 31 low

Support 3: 0.9820 August 25 low

Support 4: 0.9807 August 22 low

Support 5: 0.9788 June 7 swing low (key level)

Support 6: 0.9768 September 4 swing high