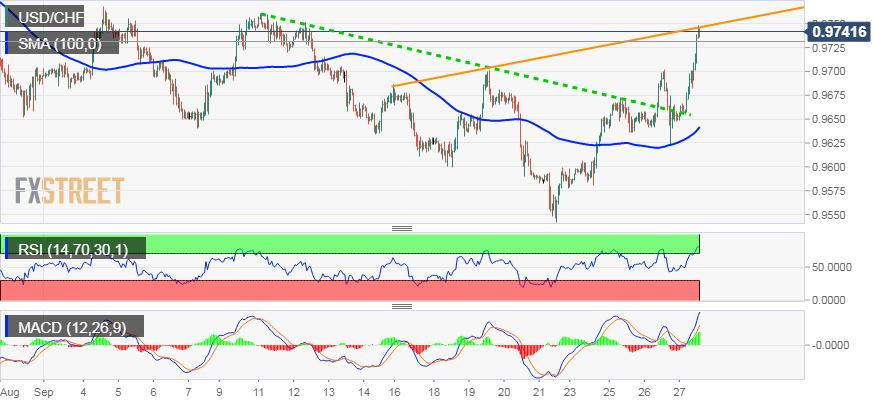

“¢ The post-FOMC slide stalled near 100-hour SMA, with bulls regaining control on Thursday and lifting the pair sharply higher beyond the 0.9700 handle.

“¢ The up-move marked a convincing breakthrough a two-week-old descending trend-line hurdle and thus, increases prospects for additional gains.

“¢ Move back above 200-day SMA adds credence to the constructive outlook, albeit overbought conditions on the 1-hourly chart warrant some consolidation.

“¢ Moreover, the bullish momentum needs to take out another ascending trend-line hurdle before traders start positioning for any further near-term up-move.

Spot Rate: 0.9742

Daily Low: 0.9646

Trend: A possible bullish consolidation

Resistance

R1: 0.9767 (monthly high set on Sept. 4)

R2: 0.9800 (round figure mark)

R3: 0.9830 (horizontal zone)

Support

S1: 0.9700 (previous resistance break-point)

S2: 0.9670 (horizontal zone)

S3: 0.9646 (current day swing low)