“¢ Global risk-aversion trade underpinned the Swiss Franc’s safe-haven appeal and was seen exerting some fresh selling pressure at the start of a new trading week.

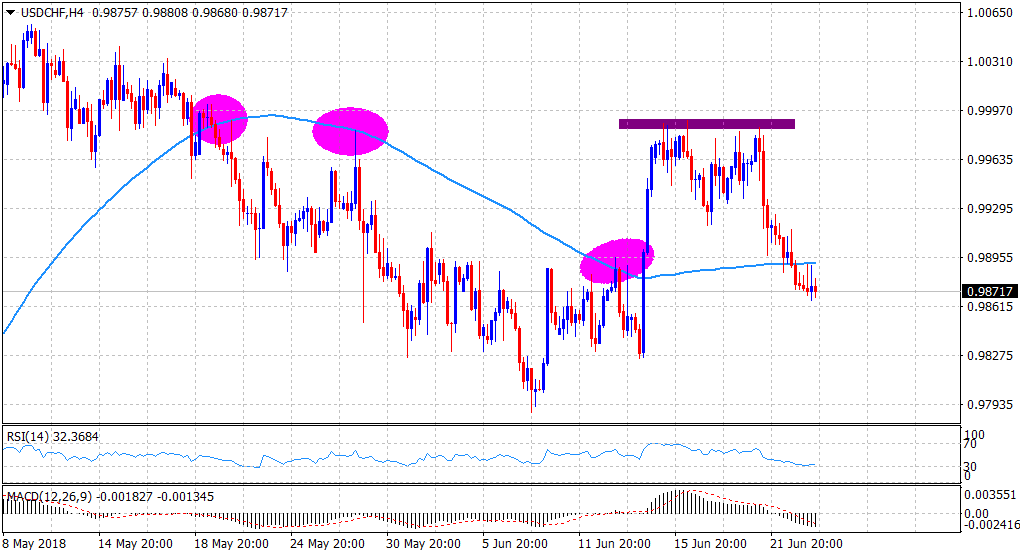

“¢ Moreover, today’s rejection near 200-period SMA adds credence to a bearish double top chart pattern near the 0.9985-90 region on the 4-hourly chart.

“¢ Short-term technical indicators are well into bearish territory and further reinforce prospects for an additional near-term downfall.

Spot Rate: 0.9872

Daily High: 0.9890

Trend: Bearish

Resistance

R1: 0.9890 (current day swing high)

R2: 0.9915 (R1 daily pivot-point)

R3: 0.9927 (100/200-period confluence hurdle H1)

Support

S1: 0.9859 (S1 daily pivot-point)

S2: 0.9826 (June 14 swing low)

S3: 0.9800 (round figure mark)