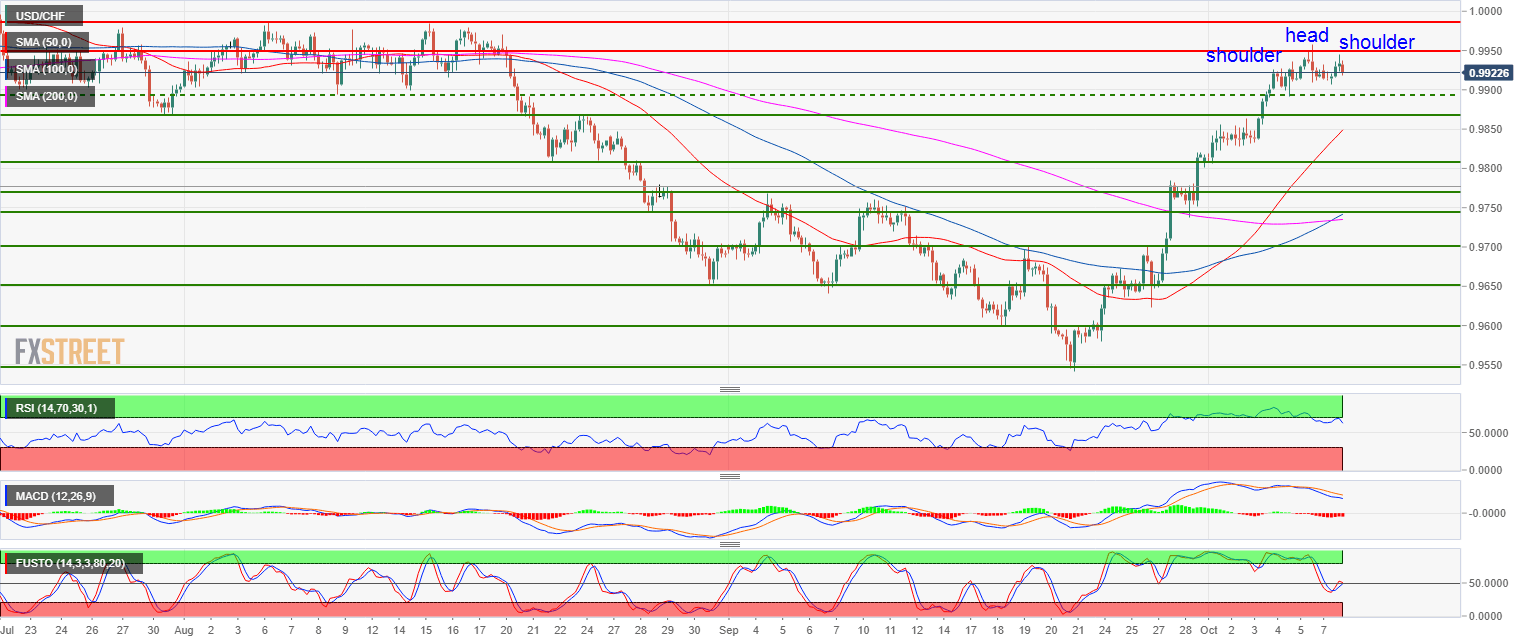

- USD/CHF is trading in a bull trend as the 50 and 100-period simple moving averages (SMA) are moving upward. The 100 SMA crossed above the 200 SMA which is considered a bullish clue known as golden cross.

- However, USD/CHF is currently stalling below the 0.9950 level as the market is forming a small head-and-shoulders pattern which can signal that a pullback can be imminent. The MACD indicator also started decelerating since early October.

- Supports to the downside can be located near 0.9891 October 4 low and 0.9868 July 31 low. A strong bull breakout above 0.9950 should lead to an acceleration to the parity level.

Spot rate: 0.9923

Relative change: 0.04%

High: 0.9945

Low: 0.9906

Main trend: Bullish

Resistance 1: 0.9950 figure

Resistance 2: 1.0000 parity level

Resistance 3: 1.0068 July 13 high

Support 1: 0.9891 October 4 low

Support 2: 0.9868 July 31 low

Support 3: 0.9820 August 25 low

Support 4: 0.9807 August 22 low

Support 5: 0.9788 June 7 swing low (key level)

Support 6: 0.9768 September 4 swing high