- USD/CHF closed the week in green maintaining the bullish outlook.

- The Greenback’s safe-haven appeal remains unquestioned.

- Jackson Hole symposium is the key event that can provide massive strength to the US dollar.

- US consumer sentiment is still sour, as indicated by the dismal retail sales figures.

- Technically, the pair is supported by the key SMAs, looking poised to gain next week.

The weekly forecast for the USD/CHF indicates that the price is likely to pause decline and initiate a bullish reversal. However, Jackson Hole Symposium can provide extreme strength to the US dollar in the second half of the week.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The USD/CHF started the week with a strong bearish bias from 0.9120 and closed the week in red at 0.9168, with a net gain of 48 pips.

Despite an unknown number of Americans missing and Afghanistan in Taliban hands, the spectacle of the Biden administration’s powerless withdrawal has heightened international concern and, perhaps absurdly, boosted the dollar.

Government bond yields in the United States fell as the market placed more importance on economic data than FOMC minutes, which were somewhat outdated.

As part of its annual three-day symposium, the Federal Reserve is kicking off in Jackson Hole on Thursday, August 26. The looming throttling has been highly suspicious; however, Fed officials will likely be reluctant to leave their options open in a US economic slowdown or job creation.

US consumption may be pressured by consumer sentiment and inflation, as retail sales fell in July after consumer sentiment declined sharply in August. However, industrial production and capacity utilization exceeded expectations despite a weak economy.

Further, the number of initial unemployment benefits applications fell to a new pandemic low. Nevertheless, consumer spending in the United States remained cautious despite a strong economic recovery.

–Are you interested to learn more about forex signals? Check our detailed guide-

Key data releases in Switzerland during Aug 23-27

There is no significant data release from Switzerland next week except Credit Suisse Economic Expectations. The data release is a non-event that may not leave any impact on the CHF.

Key data releases in the US during Aug 23-27

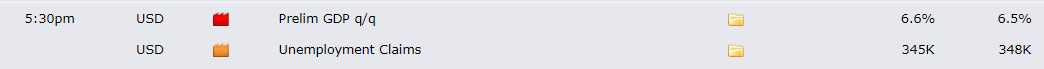

- Prelim GDP q/q: GDP is a primary gauge for economic health. The number is expected to slightly rise to 6.6% against the previous quarter’s reading at 6.5%. Upbeat figures will strengthen the odds of tapering/rate hikes.

- Unemployment claims: The weekly unemployment claims are likely to decrease to 345k against the previous week’s reading at 348k.

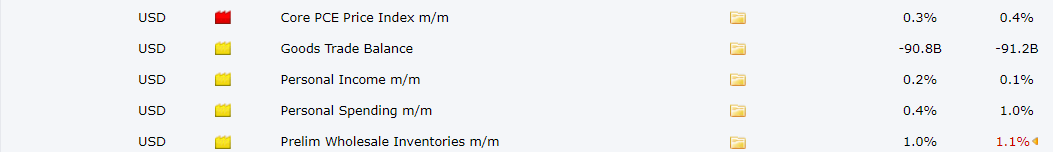

- Core PCE price index m/m: This is one of the most observed indicators to gauge the inflation and economic health of the US. The previous reading was quite dismal that had sent the dollar down. Coming reading for July is expected to slide further to 0.3%. However, any surprise (upbeat figures) can provide further support to the rising Greenback.

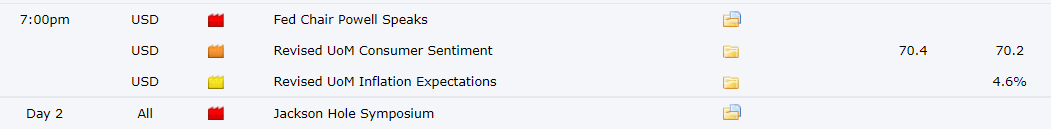

- Fed Chair Powell speaks: Investors will look for further clues about tapering and rate hikes on Friday.

- Jackson Hole Symposium (Aug 26-28): The three-day event is the most important release next week. Fed is likely to outline the plan for tapering in the symposium.

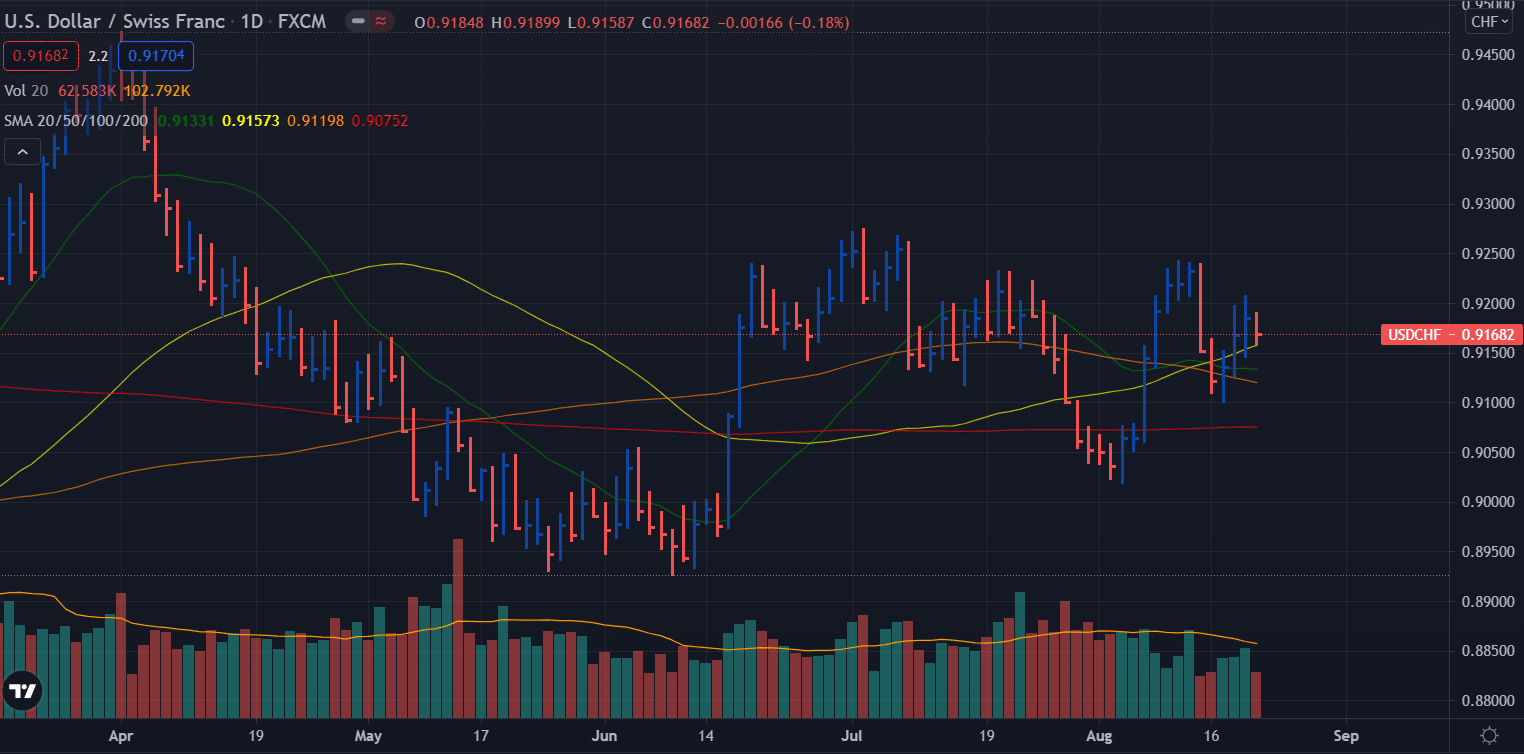

USD/CHF weekly technical forecast: Key SMAs to support upside

The USD/CHF pair remains supported by the congestion of 20, 50 and 100 day SMAs. The upside wave from Tuesday to Thursday showed a rising volume followed by a weak down bar with low volume. This indicates a “no supply” bar which is a sign of bullishness. The 200-day SMA is flat, which a point to ponder for the technical buyers is. However, this could be due to Friday’s retracement.

The upside targets could be at 0.9200 ahead of 0.9250 while on the flip side, 0.9150 will provide immediate support ahead of 0.9100.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.