- USD/CHF gained momentum for the second day in a row, moving away from one-month lows.

- Signs of equities market stability weakened the safe-haven CHF, but it remained supportive.

- A restrained USD price action may hold any further gains after the release of US Retail Sales data.

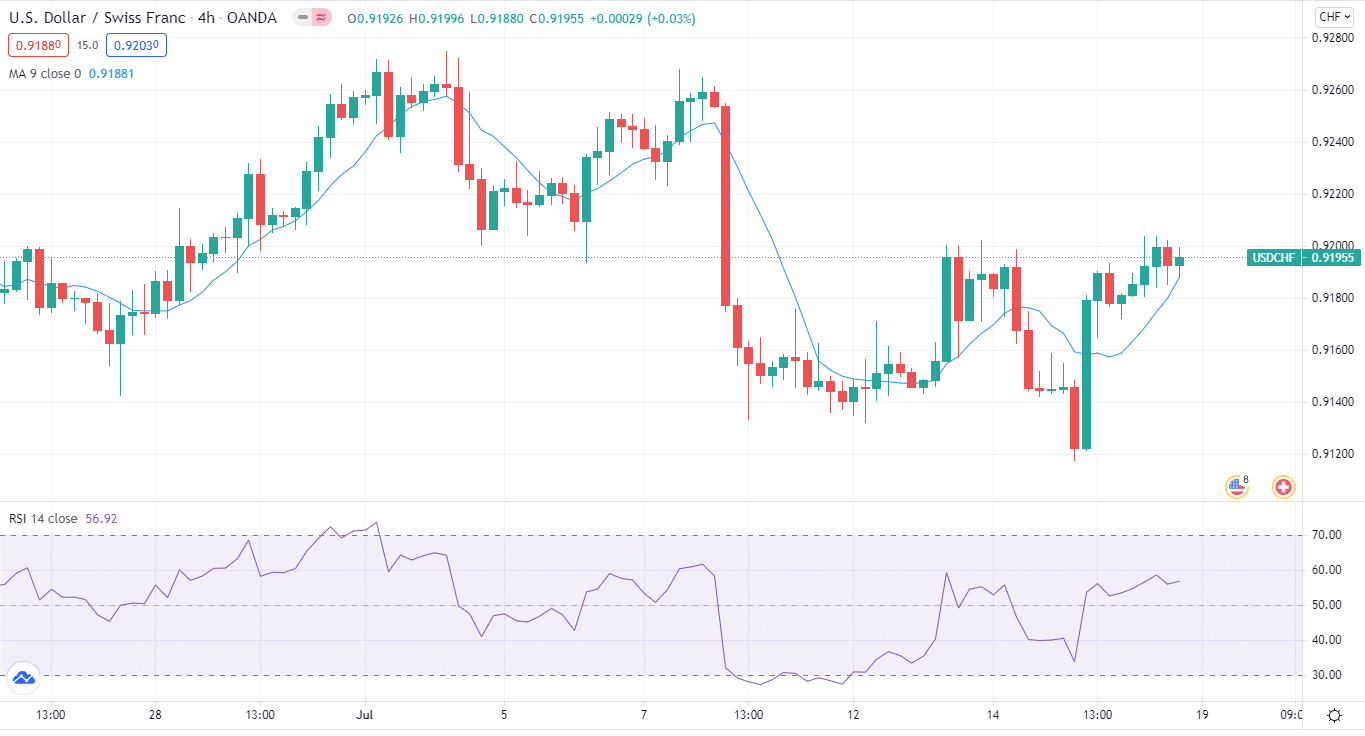

On Friday, July 16, during the first half of the European session, the USD/CHF forecast soared to over one-week highs, rallying beyond the 0.9200 level. However, the price did take a dip at the end of a trading day and is currently trailing at 0.9195.

-Are you interested to find high leverage brokers? Check our detailed guide-

During the first half of the European session of the last trading day, the USD/CHF pair soared to over one-week highs, with bulls now trying to extend the rally beyond the 0.9200 level.

The pair gained traction for the second straight session on Friday, building on the previous day’s relatively good rebound from the 0.9120-15 zone, or near one-month lows.

The increase could be attributable to some follow-through short-covering amid evidence of equities market stability, which tends to weaken demand for the safe-haven Swiss franc.

The US dollar, on the other hand, was observed swinging in a narrow trading area and failing to provide a further lift to the USD/CHF pair.

Nonetheless, a sharp rise in US Treasury bond yields, as well as anticipation that the Fed may tighten monetary policy sooner than expected, continued to support the greenback.

For the upcoming week, traders will look forward to the US economic calendar, particularly the release of monthly Retail Sales data on July 16. This, together with US bond yields, may influence USD price dynamics and provide some momentum to the USD/CHF pair.

Traders will also look for short-term opportunities based on broader market risk perception.

What’s next to watch for USD/CHF?

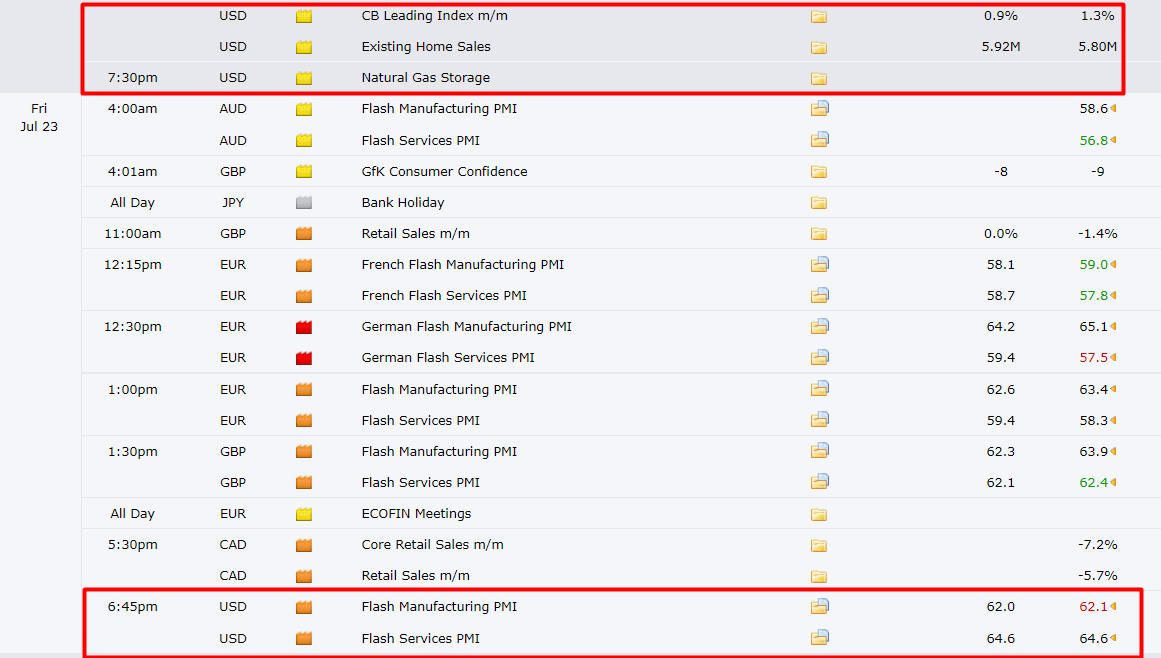

The next week has no significant data from Switzerland while the US will come up with low tiered data of existing home sales and flash manufacturing and services PMIs.

USD/CHF technical analysis: key levels in action

The USD/CHF weekly bias is neutral. On the downside, continued trading below the 55-day EMA at 0.9195 will confirm that the bounce from 0.8925 has ended at 0.9273. A deeper drop would then be expected in this scenario, leading to a retest of the 0.8925 low.

-Looking for high probability free forex signals? Let’s check out-

However, a break of 0.9273 and prolonged trade above the retracement of 0.9471 to 0.8925 at 0.9262 will seek the next resistance level at 0.9471.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.