- The USD/CHF weekly forecast is neutral as the price managed to stay within the broad range.

- The US dollar gained some ground as the US bonds market saw some traction that limited the Greenback losses.

- However, it will be hard for the dollar to develop a significant trend until the markets have a more detailed understanding of the Fed’s bond program.

The USD/CHF weekly forecast is neutral as the price managed to stay within the broad range under 0.9200 level amid unclear Fed’s stance on tapering.

-Are you looking for automated trading? Check our detailed guide-

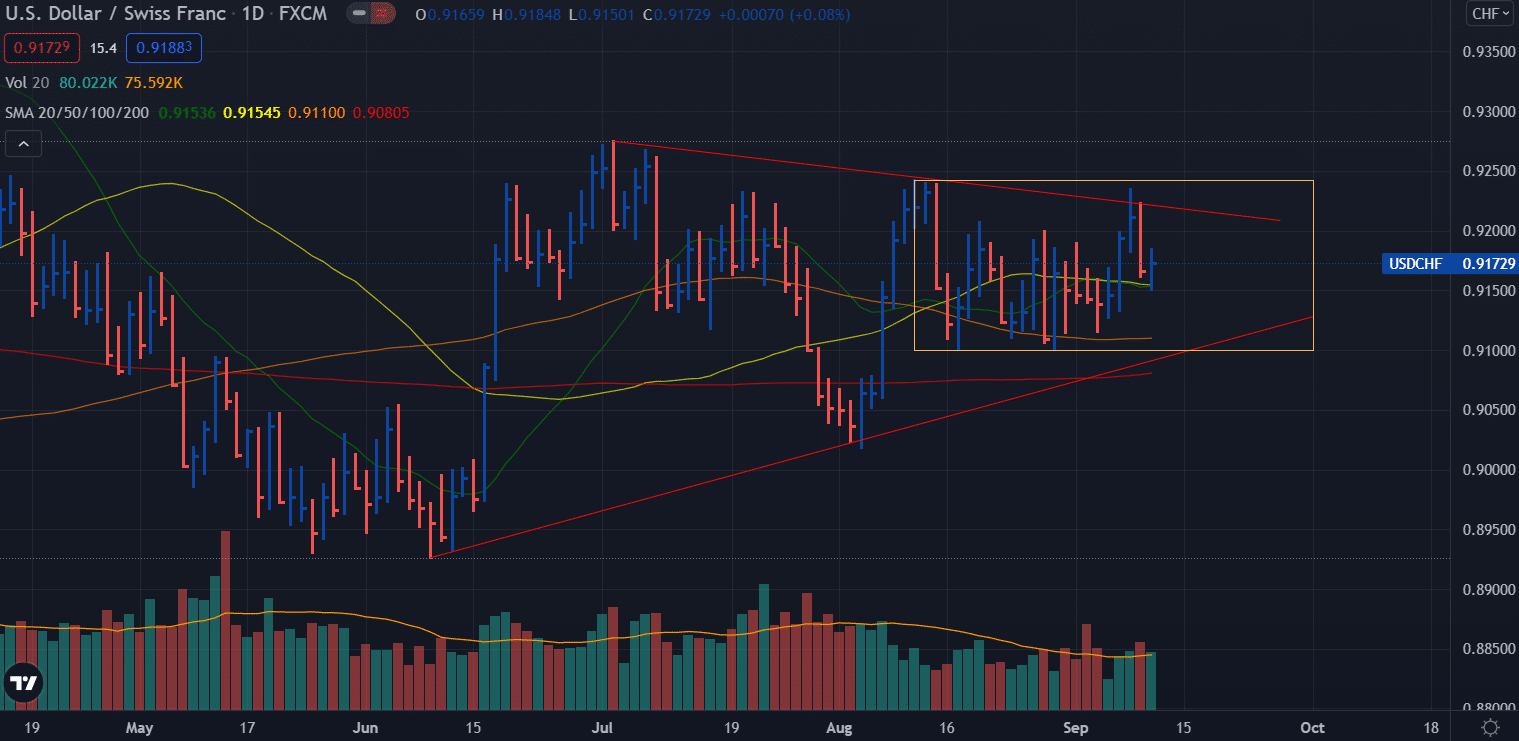

The USD/CHF pair started the week from 0.9145 level and found some respite on Monday, leading to weekly highs around 0.9235 (four-week top) on Wednesday. However, the pair found some selling pressure on the same day, which led the losses to 0.9148 on Friday. However, the week closed off the lows near 0.9172 area, showing a slight strength.

The US dollar gained some ground as the US bonds market saw some traction that limited the Greenback losses. At the same time, the CHF lost its safe-haven appeal as the risk appetite slightly improved during the week amid declining Covid cases across the globe.

Apart from this, the investors believe that Fed will soon start rolling back its massive pandemic-led stimulus program. Moreover, the US PPI data on Friday also came better than expected, which provided a little breather to the US dollar after observing several sessions of losing streaks.

US dollar temporarily rose last week as some Fed officials reiterated the need for early tapering. However, it will be hard for the dollar to develop a significant trend until the markets have a more detailed understanding of the Fed’s bond program.

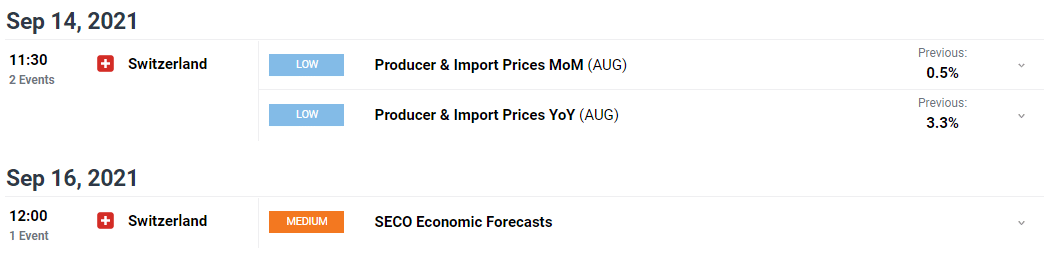

Key events in Switzerland during Sep 13 – 17

The economic calendar is light for the CHF next week. The producer and import prices data is expected to release on Tuesday, followed by the SECO environment forecast data. Both events have no potential to trigger volatile movement in the market.

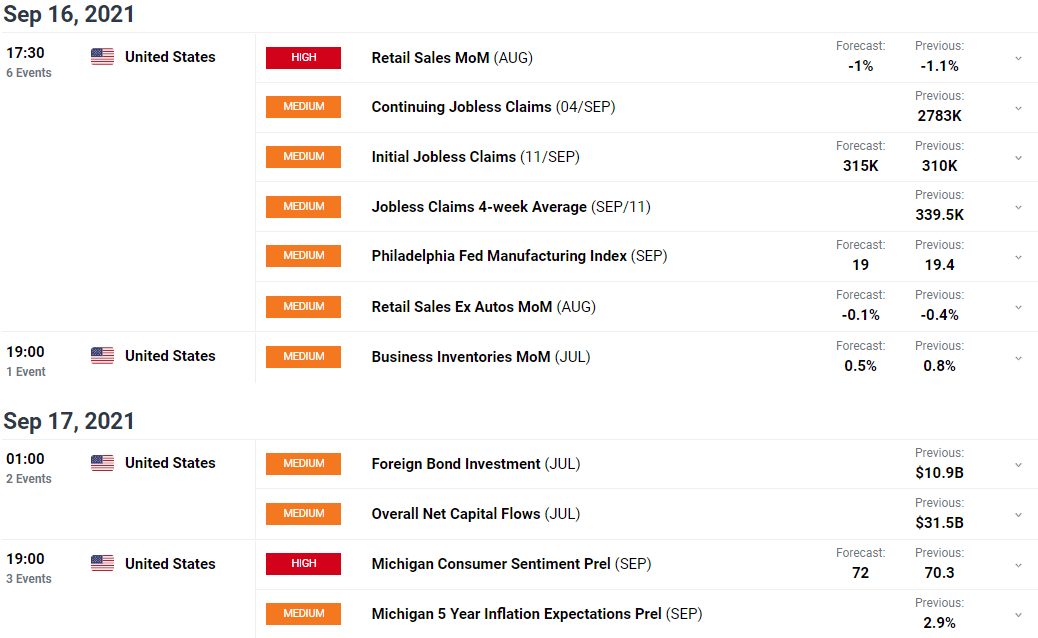

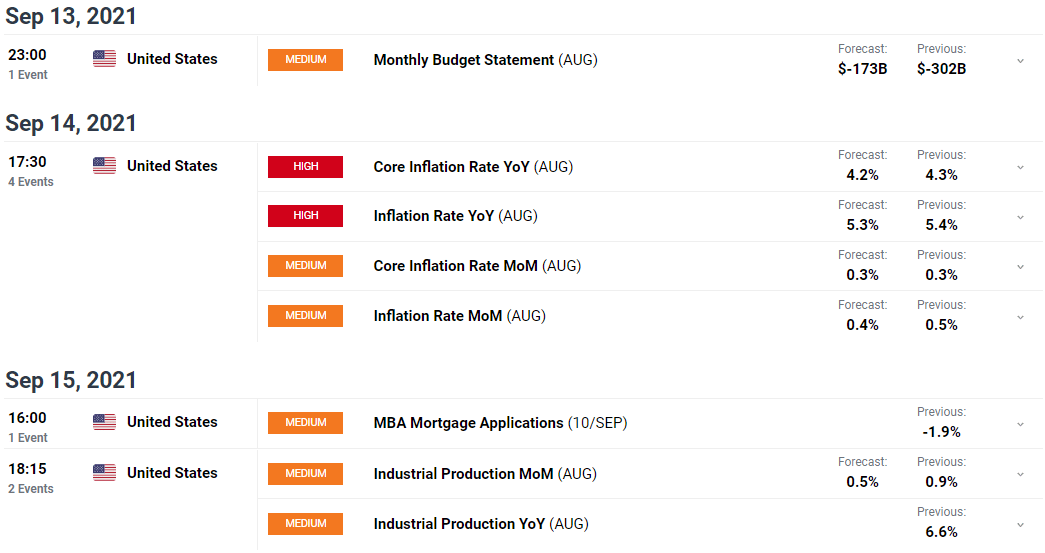

Key events in the US during Sep 13 – 17

The next week comes up with yearly core inflation data, which is expected to slightly decline. However, a major surprise in numbers can trigger a big movement in the market. Furthermore, retail sales data will be released on Tuesday, which is expected to slightly improve. Retail sales data is important as it is considered an indicator to gauge market activity. Finally, on Friday, Michigan Consumer Sentiment data is expected to release, which may support the US dollar.

-If you are interested in forex day trading then have a read of our guide to getting started-

USD/CHF weekly technical forecast: Rangebound action to continue

The USD/CHF falling prices got support at the 20-day and 50-day SMA congestion near the 0.9140 area. However, the price is still capped within the broad range of 0.9100 to 0.9245. The broader picture shows a triangle pattern on the daily chart. The entire scenario shows that the price is bound to stay choppy unless it clearly breaks out of the range. Hence, the 0.9100 – 0.9250 area will be the key focus.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.