- Business activity in the US has slowed down significantly.

- Investors have abandoned bets on the Fed’s 100 basis point rate hike.

- The price might get back to 0.95 in the coming week.

Next week’s USD/CHF weekly forecast is bearish as the US economy slows down due to rising interest rates. Markets have already priced in a 75bps hike, so the Fed would have to surprise investors for there to be a rally in USD/CHF.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Ups and downs of USD/CHF

The pair ended the week down primarily due to the US dollar’s weakness. The dollar’s weakness was brought on by economic data that pointed to slowed economic activity. Data released on Friday showed business activity in the United States shrank for the first time in about two years.

“That’s a reflection of tighter financial conditions and the fact that inflationary pressures remain elevated,” Bipan Rai, the North American head of FX strategy at CIBC Capital Markets in Toronto, said.

“Even if the US economy does slow down somewhat, I don’t think you can extrapolate some sort of medium-term dollar weakness … because we are seeing similar things elsewhere,” he added.

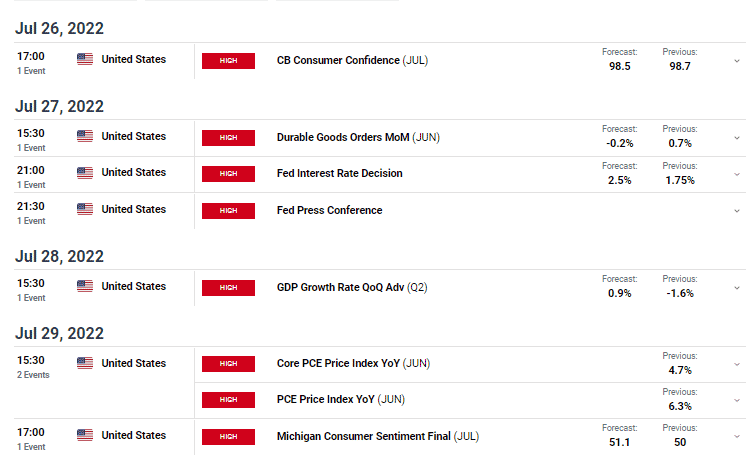

Next week’s key events for USD/CHF

In the coming week, several significant news releases from the United States will cause a lot of volatility in the pair. Investors will pay attention to the Federal Reserve’s decision on interest rates, with most investors expecting a 75bps rate hike.

“The market is quickly pricing out the possibility of the Fed being able to raise rates aggressively for the remainder of the year,” said Subadra Rajappa, head of US rates strategy at Societe Generale in New York.

Consumer confidence for July is expected to drop slightly, while Q2 GDP is expected to grow from -1.6% to 0.9%.

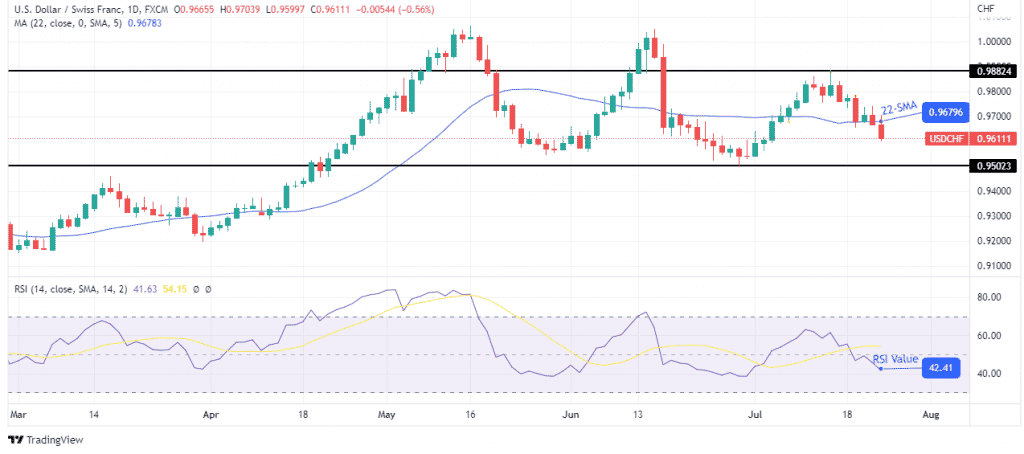

USD/CHF weekly technical forecast: Bears might retest 0.95

The 4-hour chart shows the price breaking and closing below the 22-SMA. This move is a sign that bears are back and they are strong. The RSI is trading below 50, also favoring bearish momentum.

–Are you interested to learn about forex robots? Check our detailed guide-

The price might retest the 22-SMA as resistance at this level before heading lower. The next target for bears will be at 0.95023, which acted as support on June 29. A break below this level would lead to a lower low, confirming the bearish trend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.