- USD/CNH drops to fresh low since late June 2018 following data.

- China’s Caixin Manufacturing PMI drops to 53.00 in December.

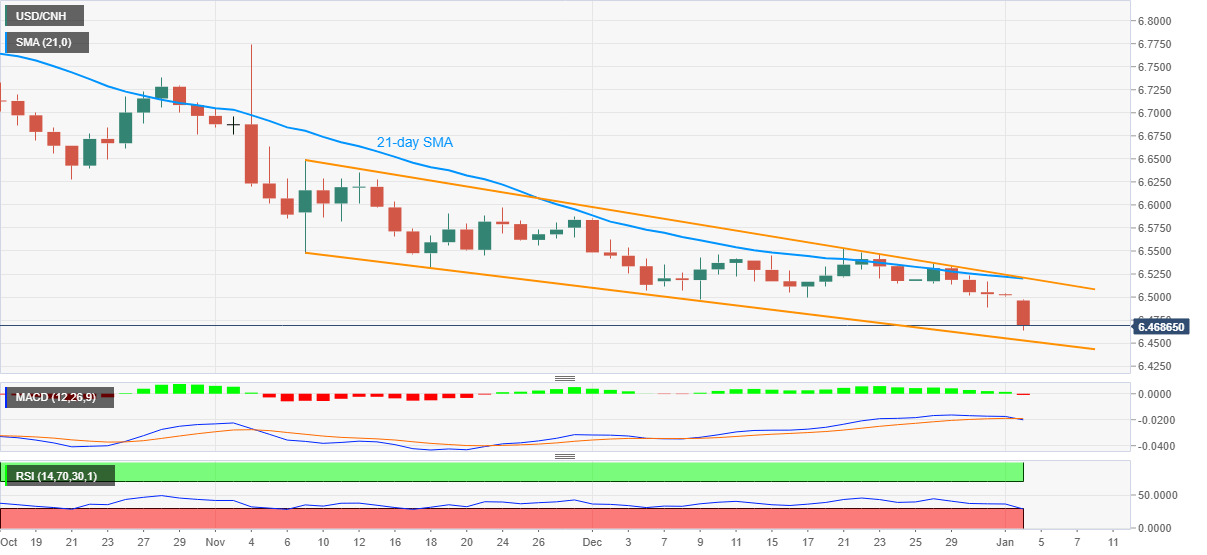

- MACD suggests further downside to channel support but RSI probes bears.

USD/CNH drops to the lowest since June 2018 while ignoring China’s December month Caixin Manufacturing PMI. The quote currently stands on a slippery ground near 6.4695, down 0.51% intraday, during early Monday.

China’s Caixin Manufacturing PMI slipped below 54.9 forecast and expected to 53.00 but marked a consecutive eighth print suggesting expansion in manufacturing activities of the world’s second-largest economy.

Read: Chinese December 20 Caixin Manufacturing PMI 53.0 vs exp 54.7; prev 54.9

A downward sloping trend channel from early November portrays the USD/CNH traders’ bearish bias. Further, MACD is also teasing the sellers by the time of writing.

As a result, USD/CNH bears are targeting the support line of the stated channel, at 6.4528, before eyeing the June 2018 low near 6.3760.

However, oversold RSI conditions suggest corrective pullback towards regaining the 6.5000 round-figure.

Though, a confluence of 21-day SMA and channel’s upper line near 6.5200 will be a tough nut to break for USD/CNH buyers.

Overall, USD/CNH is in a bearish trajectory with momentum oscillators suggesting an intermediate pullback.

USD/CNH daily chart

Trend: Bearish