- USD/CNH refreshes intraday low after PBOC kept interest rates unchanged.

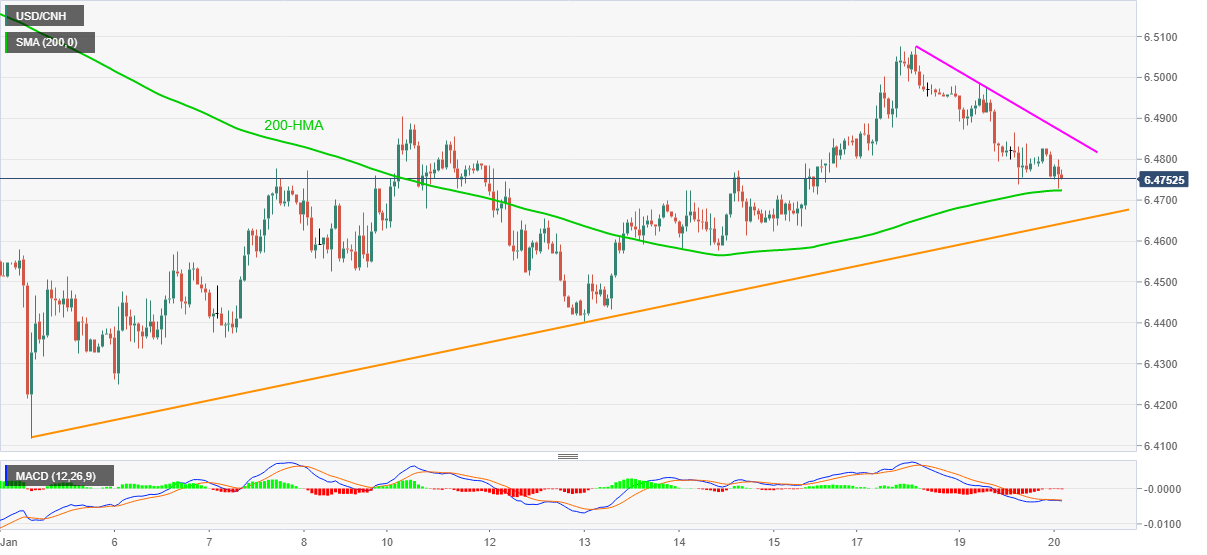

- 200-HMA, two-week-old rising trend line probe short-term sellers.

- Weekly descending trend line guards immediate upside amid sluggish MACD.

USD/CNH fails to justify the People’s Bank of China’s (PBOC) status-quo while refreshing weekly low to 6.4728 during early Wednesday. The currency pair portrays a corrective pullback to 6.4765, down 0.05% intraday, by press time.

Read: The PBoC Interest Rate Decision unchanged

Despite the quote’s latest losses, USD/CNH sellers should remain cautious unless witnessing a downside break of an ascending trend line from January 05, at 6.4640 now. It’s worth mentioning that the 200-bar SMA offers immediate support near 6.4720.

In a case where USD/CNH bears dominate below the stated support line, the last Wednesday’s low near 6.4400 should return to the chart.

Meanwhile, a descending trend line from Monday, currently near 6.4870, will probe the short-term upside of the USD/CNH prices ahead of the key resistance line from November 24 near 6.5015.

Also acting as an upside barrier is the monthly top surrounding 6.5050, a break of which can recall USD/CNH buyers targeting December top near 6.5855.

USD/CNH hourly chart

Trend: Pullback expected