- USD/CNH risk reversals have hit the highest in over 2.5-years.

- Investors are adding bets to position for a weaker Yuan.

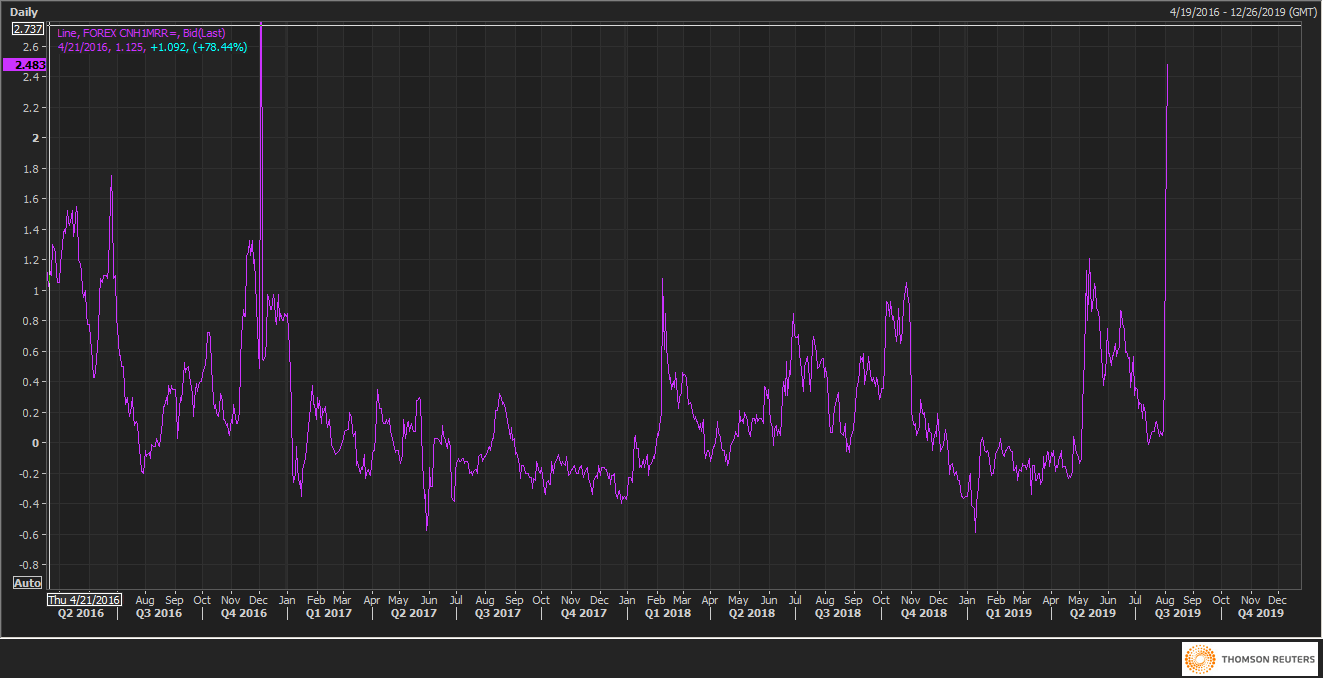

One-month risk reversals on USD/CNH (CNH1MRR), a gauge of calls to puts on the offshore Yuan, rose to 2.483 soon before press time. That is the highest level since December 2016.

The gauge stood at 1.392 on Friday.

The surge indicates the investors are adding bets to position for an extended sell-off in China’s Yuan.

Positive USD/CNH risk reversals indicate the implied volatility premium or demand for CNH puts or bearish bets is higher than that for CNH calls or bullish bets.

The USD/CNH pair rose above 7 earlier today and hit a high of 7.1086, courtest of escalating US-China trade tensions. As of writing, it is trading at 7.0824, representing 1.57% gains on the day.

CNH1MRR