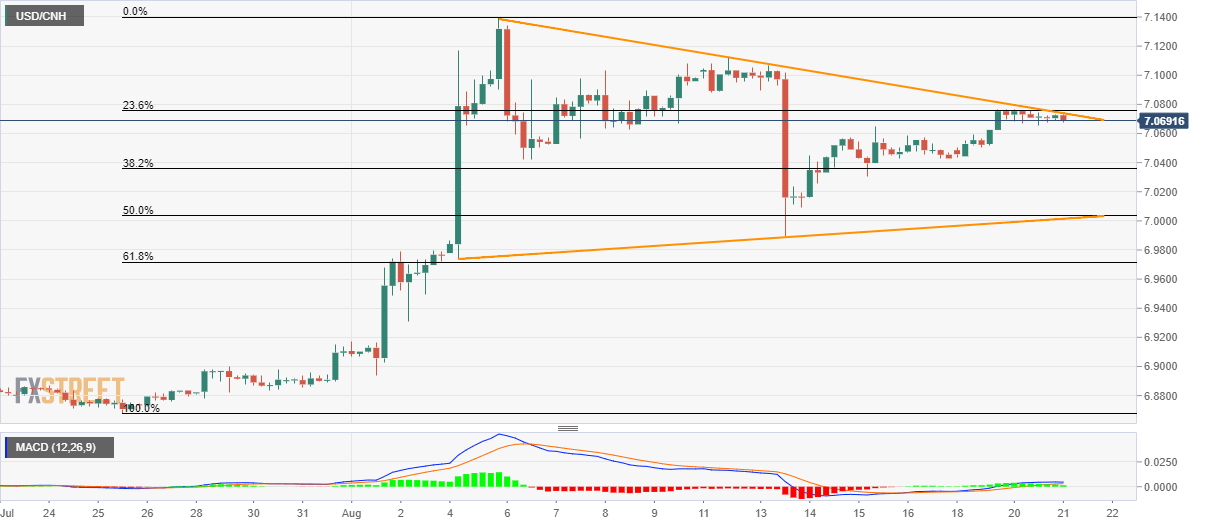

- USD/CNH struggles around near-term descending trend-line, 23.6% Fibonacci retracement.

- A two-week-old symmetrical triangle limits the pair’s moves.

USD/CNH trades near short-term key resistances as it takes the rounds to 7.07 during Wednesday’s Asian session.

With the two-week-old descending trend-line and 23.6% Fibonacci retracement of late-July to early-August rise limiting the pair’s immediate upside around 7.0757/40, prices are likely to witness a pullback towards multiple supports around 7.0570 numbers.

However, 38.2% Fibonacci retracement level of 7.0360 and 7.0240 might question sellers afterward, if not then 7.0037/15 area including triangle support and 50% Fibonacci retracement will lure bears.

If at all buyers manage to conquer 7.040/57 resistance-confluence, last week’s high surrounding 7.1127 and monthly top near 7.14 will be bulls’ favorites.

USD/CNH 4-hour chart

Trend: Pullback expected