- RSI recovery/ascending triangle enables the USD/CNH pair to aim for key resistance confluence.

- Trade tussles join, fraud scandal at home weakens the Chinese currency off-late.

- 6.85 offers strong downside support.

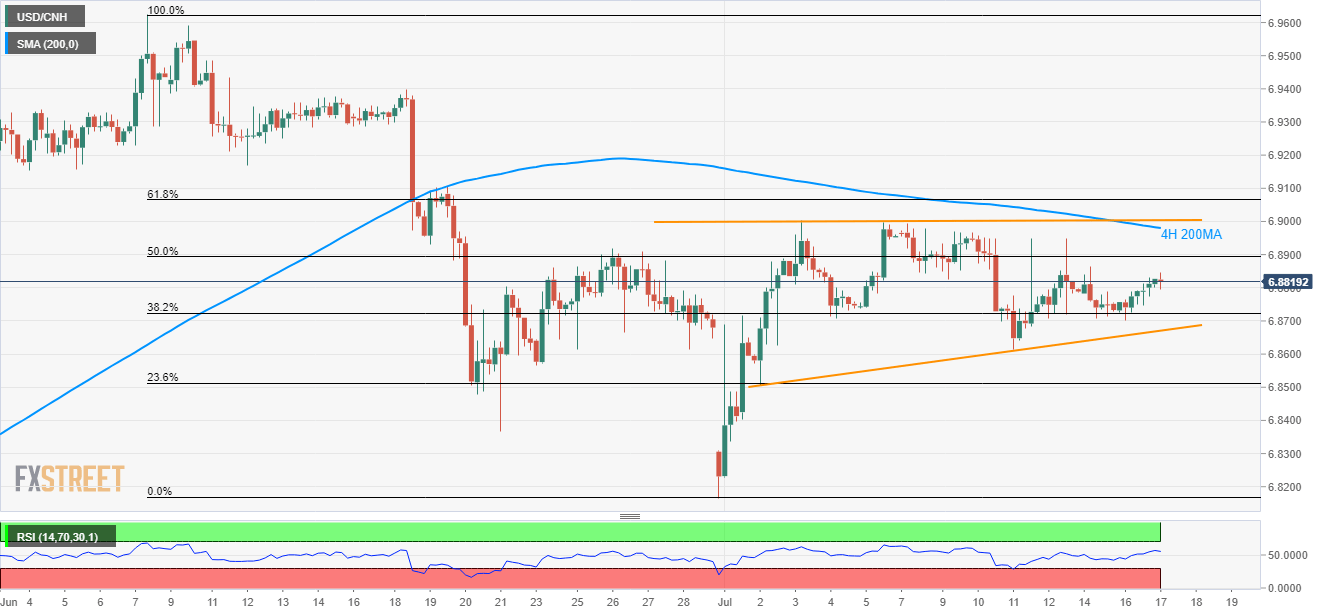

Although 2-week old ascending triangle formation and rising RSI favor the USD/CNH pair’s additional recovery, the quote still trades below key resistances as it takes the rounds to 6.8825 on early Wednesday.

On a separate note, the US-China trade stalemate intensified recently after the US President Donald Trump cited “a long way” to expect a deal with China while also threatening to levy fresh tariffs. Further, Camsing fraud scandal at home also drags China’s offshore Yuan (CNH).

50% Fibonacci retracement of June month declines, at 6.8894, acts as immediate resistances ahead of highlighting 6.88/90 confluence region comprising 200-bar moving average (4H 200MA) and a horizontal line stretched since early-month.

In a case prices refrain from respecting 14-bar relative strength index (RSI) and rally beyond 6.90, June 19 high around 6.9103 and 6.9155 may lure buyers.

On the downside, triangle pattern support around 6.8671 seems key to watch as the break of which can trigger fresh downpour to sub-6.8500 area.

USD/CNH 4-hour chart

Trend: Pullback expected