- USD/CNH stays near three-week-high after breaking 21-DMA.

- Bulls struggle to cross 1.5-month-old horizontal resistance amid likely reversal of bearish MACD.

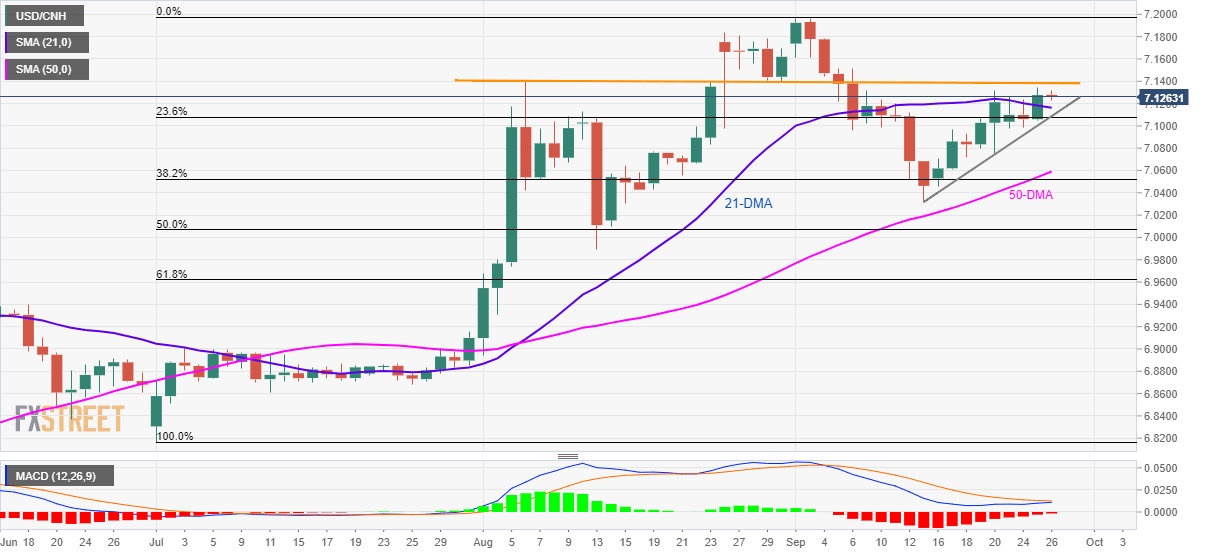

Despite successfully trading above the 21-day simple moving average (21-DMA), USD/CNH is yet to cross near-term key resistance as it makes the rounds to 7.1295 during early Thursday.

Adding to the odds favoring pair’s further upside is likely reversal of 12-bar moving average convergence and divergence (MACD) indicator’s bearish signal.

As a result, buyers will keep a close eye on sustained upside momentum beyond 7.1400/10 horizontal-line including highs marked on August 06/23 and August 29/30 lows.

Following that, 7.1620 and 7.1840 could be their next targets ahead of 7.1967 and 7.2000.

Alternatively, pair’s break below 21-DMA level of 7.1164 can take rest on two-week-old rising trend-line and 23.6% Fibonacci retracement level of June-September upside, around 7.1075/90.

In a case where prices decline below 7.1075, 50-DMA level of 7.0562 and monthly bottom close to 7.0300 could please bears.

USD/CNH daily chart

Trend: bullish