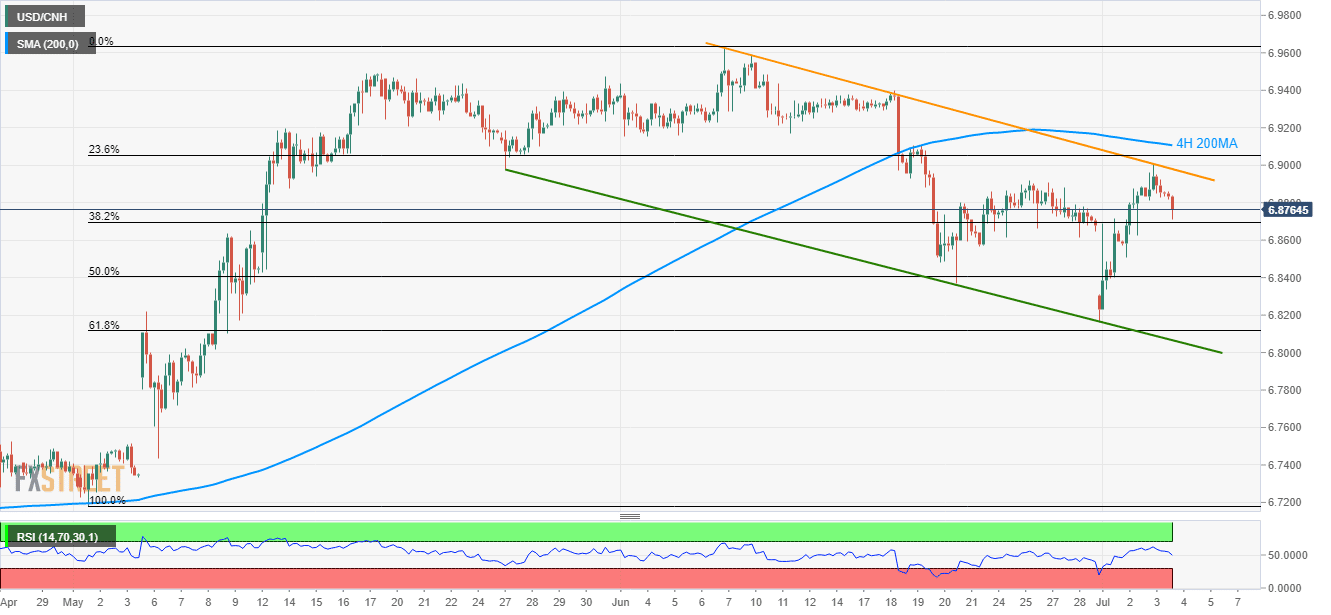

- 4H 200MA, a month-old resistance-line limits immediate upside of the USD/CNH pair.

- 61.8% Fibonacci retracement, near-term descending trend-line seem key supports.

USD/CNH registered another U-turn from 4-week old resistance line as it takes the rounds to 6.8745 during early Asian morning on Thursday.

With the latest pullback, 50% Fibonacci retracement of May-June upside, at 6.8405 should gain sellers’ attention. However, 61.8% Fibonacci retracement at 6.8112 and a downward sloping trend-line since late-May at 6.8066 can restrict further declines.

If at all bears refrain from respecting short-term support-line, 6.7500 may appear on their radars to target.

Alternatively, the aforementioned resistance-line at 6.8980 and 200-bar moving average (4H 200MA) near 6.9106 can limit the pair’s advances.

Given the price rally beyond 6.9106, 6.9400 and 6.9625 can be targeted if holding long positions.

USD/CNH 4-hour chart

Trend: Bearish