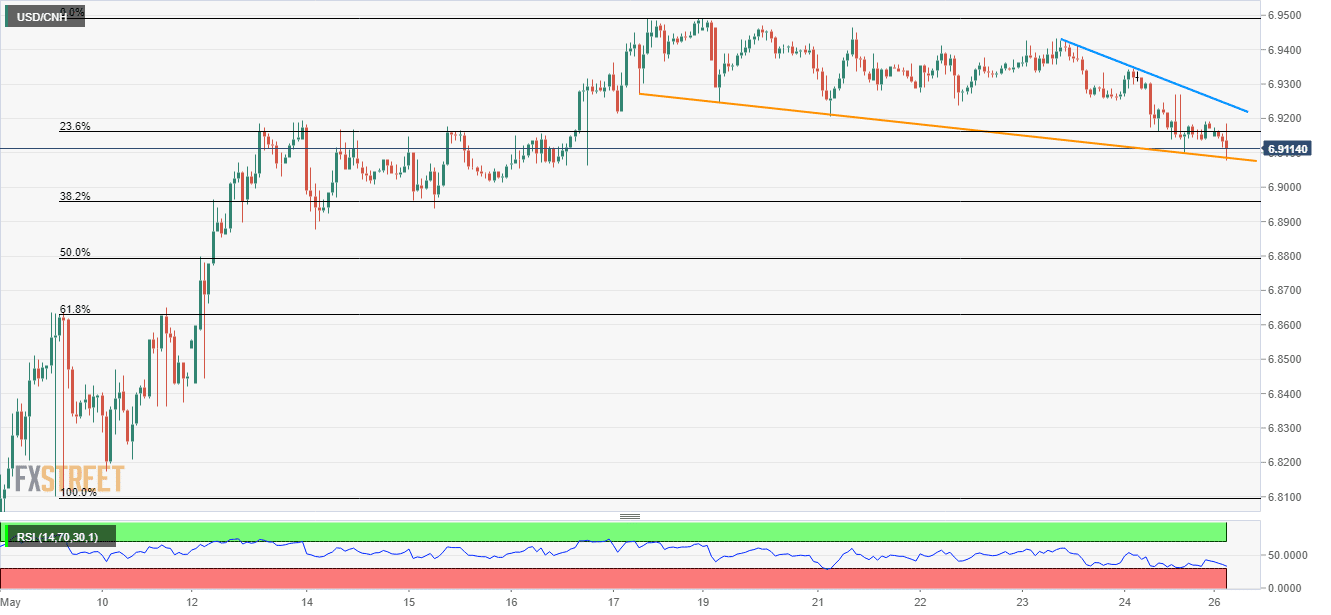

- Oversold RSI and immediate trend-line support can trigger the pair’s pullback.

- Adjacent resistance-line can restrict upside momentum.

Extending its gradual downturn since middle of last week, USD/CNH trades near 6.91 at the initial Monday.

Near to the quote is 10-day long descending support-line, at 6.9085, that has been questioning sellers together with oversold levels of the 14-bar relative strength index (RSI).

If bears refrain from respecting immediate trend-line support, 38.2% Fibonacci retracement of recent upside at 6.8966 and 50% Fibonacci retracement near 6.8794 can appear on their radar.

Meanwhile, 6.92 and the closest descending trend-line near 6.9243 may limit pair’s immediate upside ahead of aiming 6.9350.

Also, the pair’s sustained rise past-6.9350 enables the buyers to target recent high near 6.9490.

USD/CNH hourly chart

Trend: Pullback expected