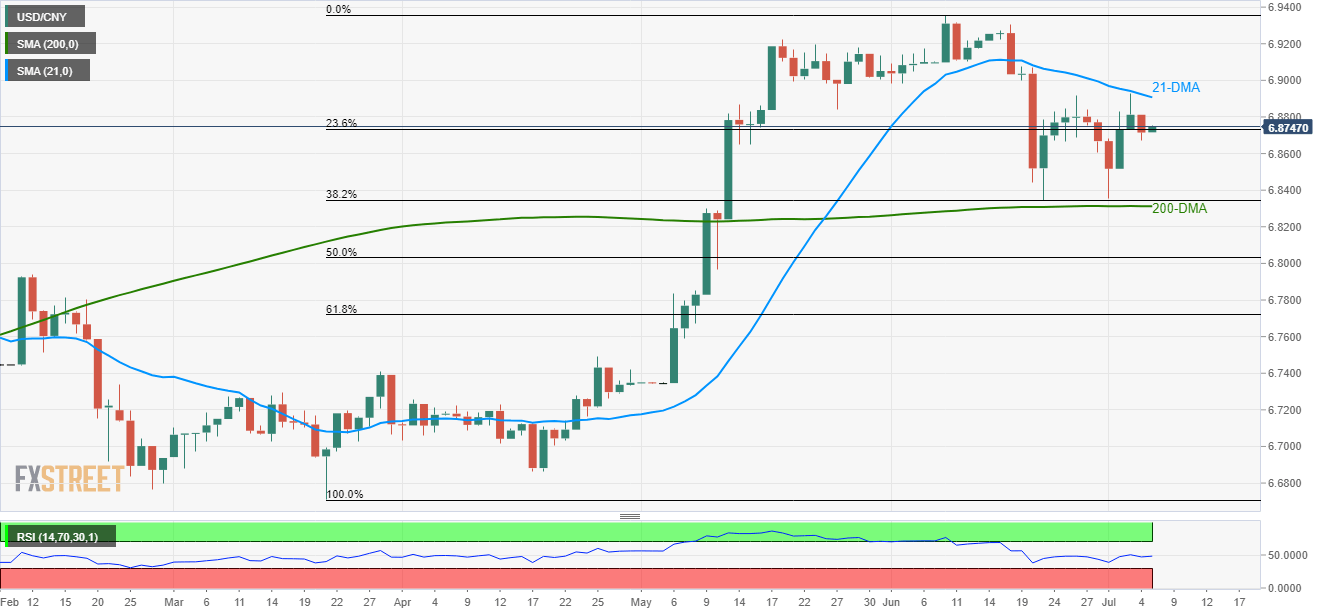

- 38.2% Fibonacci retracement, 200-DMA limits the USD/CNY pair’s downside with 21-DMA guarding the opposite side.

- 6.9000 offers additional filter towards the north.

Although failure to cross the 21-day moving average (21-DMA) portrays the USD/CNY pair’s weakness as it trades near 6.8716 during early Friday, quote’s downside has been confined by 38.2% Fibonacci retracement of March-June upside and 200-day moving average (200-DMA).

Considering the pair’s latest pullback, 6.8647 and 6.8520 might entertain short-term sellers ahead of challenging them with the key 6.8345/12 support-confluence.

Given the bears’ ability to drive prices down 6.8312, a plunge to an early-May high of 6.7834 can’t be denied.

Alternatively, an upside clearance of 21-DMA level of 6.8907 can trigger the pair’s fresh rise towards 6.9000 round-figure whereas 6.9223 and June month high around 6.9357 might please buyers afterward.

USD/CNY daily chart

Trend: Sideways