- The US Mid-Term Elections are heating up with one week to go.

- House polls show Democrats are consolidating their gains.

- The US Dollar could be negatively affected.

The US Mid-Term Elections are on November 6th, just one week to go. The scene is heating up with President Donald Trump trying to focus the attention on immigration. On Monday, the Commander in Chief announced sending more US troops to the southern border with Mexico. And today the White House is touting ending citizenship rights by birth. The focus is shifting away from the bombs sent by a Trump supporter and the hate crime of shooting in the Pittsburgh synagogue.

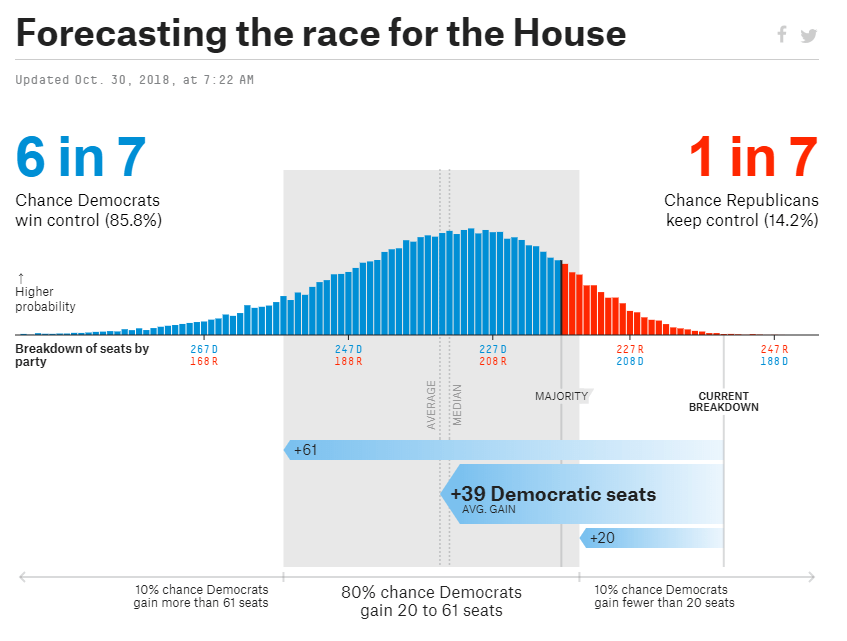

Nevertheless, the polls show that Democrats are enjoying increasing chances of winning the House of Representatives. Nate Silver’s FiveThirtyEight shows an 85.5% chance of a Democratic victory in the House according to the Classic version. This is a bit above the average seen in recent weeks.

This version factors in opinion polls, fundraising, past voting, historical trends and more. It shows an average gain of 39 House seats, well above 22 needed to flip the lower chamber.

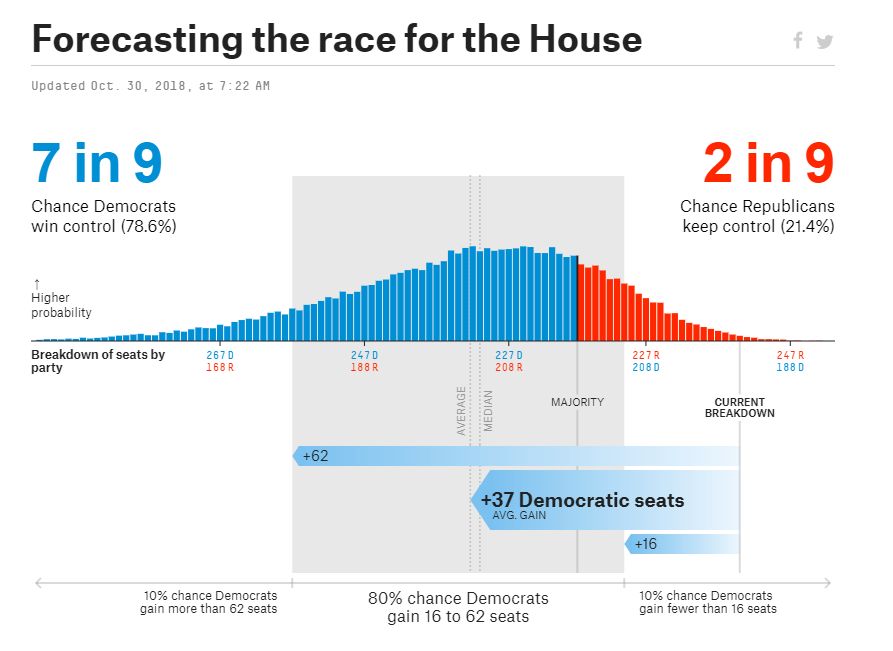

Also according to the more conservative version, the Lite one, which only counts polls, the opposition party is in the lead. Chances stand at 78.6% with a gain of 37 seats: Also here, the latest numbers are touching the highest levels. There is no sign of a Republican comeback.

It is important to note that anything can happen in seven days and that nothing is certain until the last vote is counted.

Republicans are set to retain the majority in the Senate.

Dems and the US Dollar

Mid-term elections did not matter too much to markets. However, this time is different. The political scene has a growing impact on all financial markets including currency ones. The tax cuts, economic growth, and the consequent interest rate hikes have all pushed the greenback higher.

If Democrats win the House, the government will be split once again. Political gridlock and no new tax cuts may weigh on the US Dollar. While this has been the baseline scenario for quite a while, the controversy around the appointment of Brett Kavanaugh to the Supreme Court has been seen as helping Republicans.

With the current US Dollar rally still in play, growing chances of Republicans to take the House may limit any further gains as tension mounts ahead of the event.

More: What the US mid-term elections mean for currencies: everything you need to know