The US dollar is certainly back on track following the strong GDP numbers.

Does this change the whole dynamic? This isn’t the only force:

Here is their view, courtesy of eFXnews:

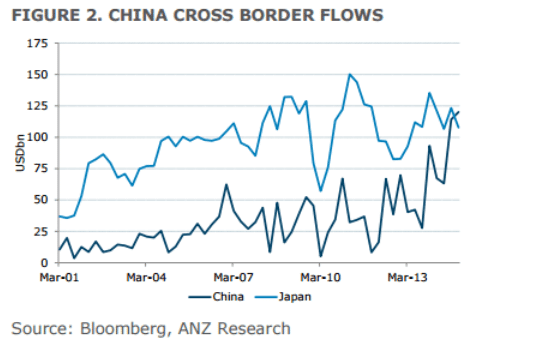

“For the G3, we may start to see some different dynamics emerge. The driver of JPY strength is clear – risk appetite. But a key driver of EUR strength has likely been the unwind of structural EUR funding positions. Certainly out of China and other parts of EM, some portion of external liabilities have been switched into EUR. These shorts are being squeezed. At some point this flow will likely run its course. Even if it persists, we are likely to see growing discomfort from European policymakers with the strength of the EUR.

In fact, further strength in both the EUR and JPY is likely to increasingly face policymaker resistance. While there have been signs in both regions that the policy easing that has been delivered is having some benefit for the domestic growth cycle, the weak state of exports suggests policymakers will be cautious about allowing markets to run too far with the current theme of strength.

It’s not obvious that a meaningful policy response will be seriously considered, but at the very least this dynamic suggests the clearest currency trends remain in the periphery rather than the core.”

Richard Yetsenga – ANZ

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.