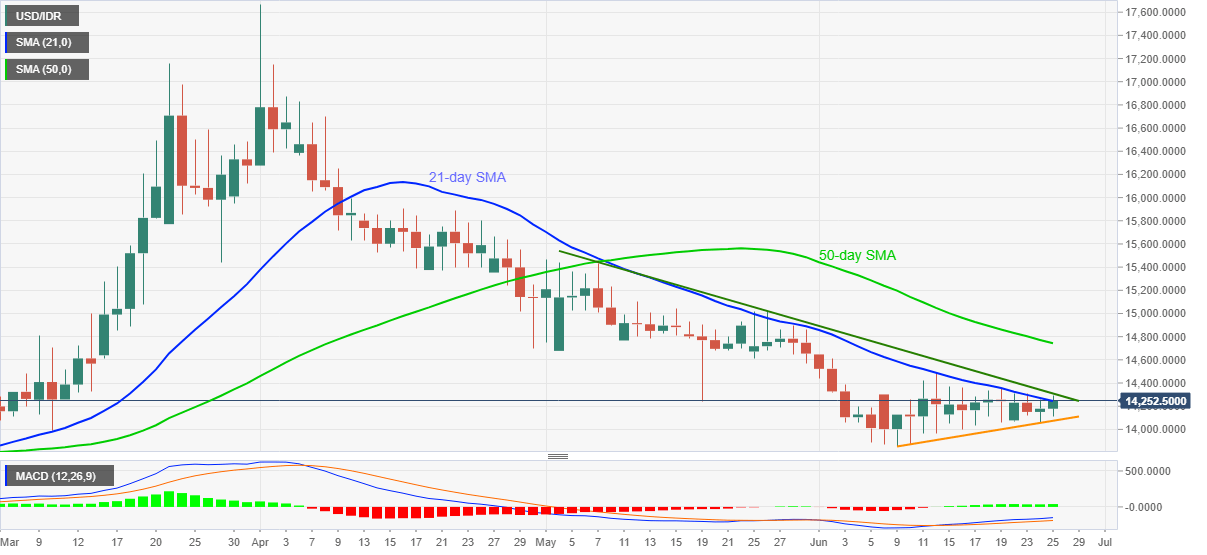

- USD/IDR extends recovery from 14,058.45 to confront 21-day SMA.

- A descending trend line from May 07 adds to the upside barriers.

- Sellers will wait for fresh weekly low to aim for June 09 bottom.

USD/IDR prints 0.53% gains while taking the bids near 14,253 during the pre-European session on Thursday. The pair pierces immediate SMA resistance while staying below a seven-week-old falling trend line. However, its gradual pullback since June 09 gains support from bullish MACD signals to keep the buyers hopeful.

As a result, the quote is likely to attack the short-term key resistance line, at 14,310 now, during the further upside. Though, a clear break above 14,310 will escalate the rise towards the monthly top close to 14,645/50.

If at all the USD/IDR prices remain strong beyond 14,650, a 50-day SMA level of 14,743 could gain the market’s attention.

Meanwhile, an upward sloping trend line from June 09, adjacent to 14,075/70, offers immediate support to the pair, a break of which could challenge the monthly low near 13,853. It’s worth mentioning that the 14,000 threshold could offer additional stop during the fall between said trend line and the monthly trough.

USD/IDR daily chart

Trend: Pullback expected