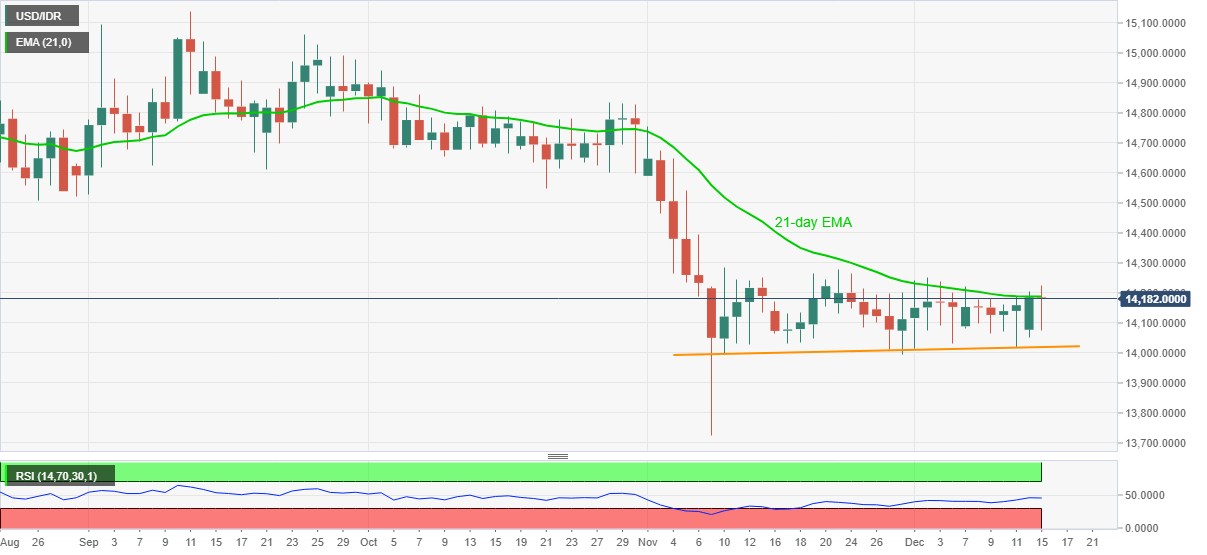

- USD/IDR battles 21-day SMA since early December.

- Indonesian Exports jump 9.54%, Imports recover to -17.46% YoY in November.

- Five-week-old support line restricts short-term downside.

USD/IDR eases from the highest since December 03 to currently around 14,185 during the early Tuesday. The quote’s recent weakness takes clues from Indonesia’s upbeat trade numbers for November.

While the headlines Trade Balance rose past-$2.29 B forecast to $2.62B, Exports mark a notable jump from -4.36% market consensus to 9.54% YoY. On the same line, Imports also recovered from -26.93% prior and -18.67% expected to -17.46% on the yearly basis during the stated period.

Not only upbeat data but the quote’s repeated failures to cross 21-day EMA in the last two weeks also directs the USD/IDR sellers towards an ascending trend line from November 10, at 14,019 now.

However, any further weakness past-14,019 will have to conquer the 14,000 round-figure before revisiting the previous month’s bottom surrounding 13,726.

Meanwhile, a daily closing beyond the 21-day EMA level of 14,190 should cross the late-November highs near 14,280 before recalling the USD/IDR bulls targeting the August 26 low of 14,508.

USD/IDR daily chart

Trend: Pullback expected