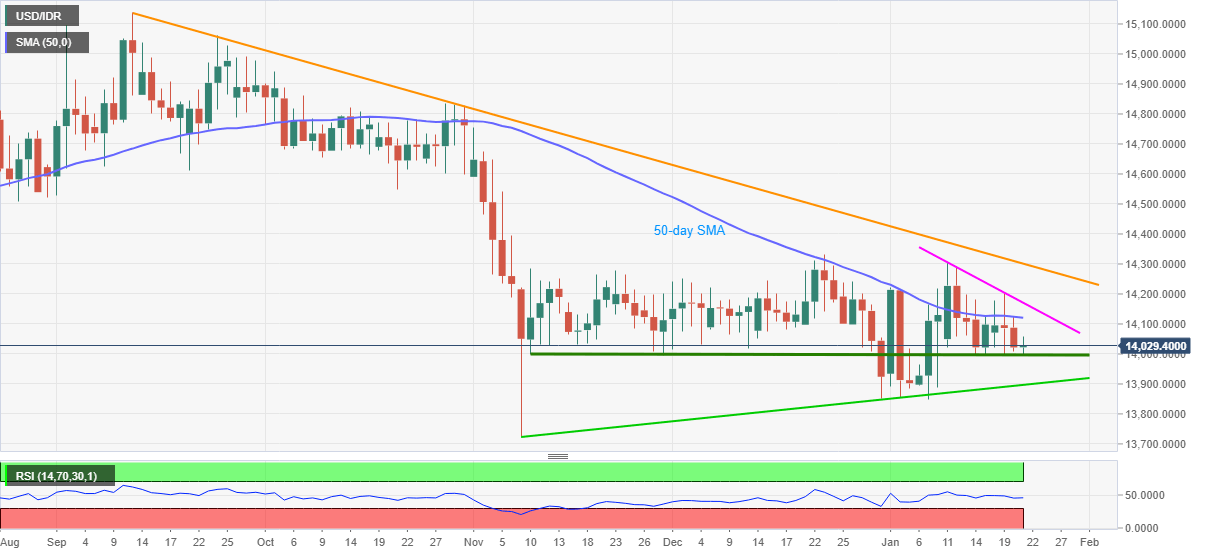

- USD/IDR bounces off ten-week-old horizontal support, eyes 50-day SMA.

- Bank Indonesia (BI) is expected to stand pat, USD/IDR may keep corrective pullback.

- Key resistance lines stand tall to challenge bulls.

USD/IDR wavers around multi-day-old horizontal support, despite a recent bounce to 14,025, during early Thursday. In doing so, the quote also justifies the Indonesian rupee (IDR) traders’ cautious sentiment ahead of the BI rate decision.

Read: USD/IDR to advance nicely towards 13,800 by end-2021 – Standard Chartered

While the expected no change in Bank Indonesia’s monetary policy and challenges for China, amid Biden Presidency, could weigh on the IDR, which in turn can propel the quote towards a 50-day SMA level of 14,120.

However, the quote’s upside past-14,120 will be challenged first by the weekly resistance line and then a falling trend line from September 2020, respectively around 14,170 and 14,300.

On the contrary, a surprise announcement will have to break the stated immediate support near 14,000 to direct USD/IDR sellers toward an ascending support line from November, at 13,895 now.

In a case where the USD/IDR bears dominate past-13,895, the previous yearly low near 13,725 will be in focus.

USD/IDR daily chart

Trend: Pullback expected