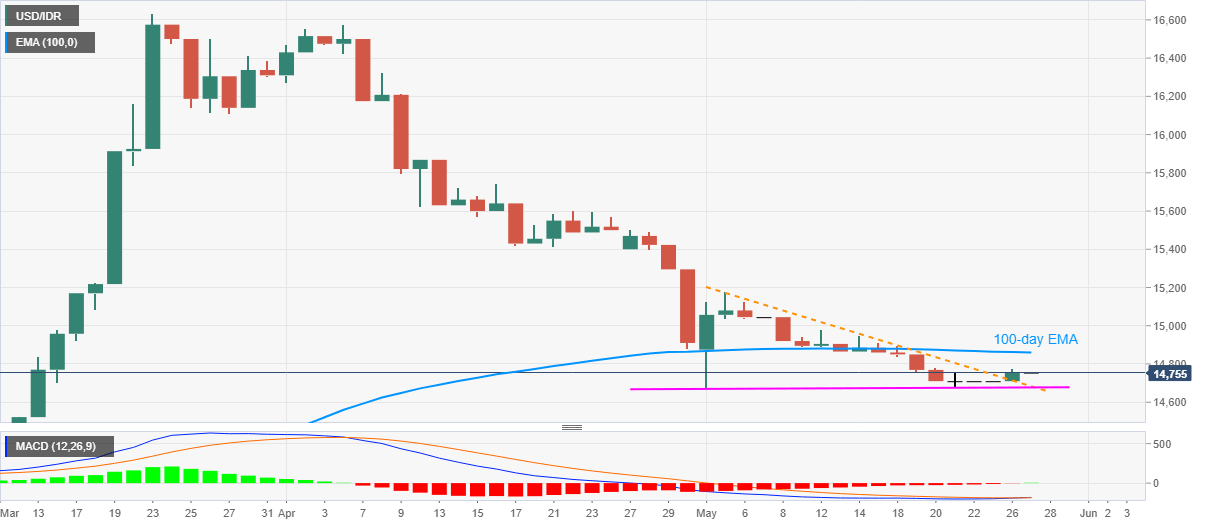

- USD/IDR buyers pause after refreshing weekly top of 14,778 the previous day.

- MACD teases bulls following the break of near-term key resistance line, now support.

- 100-day EMA gains attention during further upside, bears will refrain entries unless witness fresh monthly low.

Having benefited from the break of monthly resistance line the previous day, USD/IDR seesaws around 14,755 during Wednesday’s Asian session.

Other than the sustained trading beyond the previous resistance line, MACD histogram also keeps the bulls hopeful.

As a result, a 100-day EMA level of 14,860 is in the spotlight during further upside. Though, 15,000 round-figure and the May 05 top near 15,180 could question the buyers afterward.

Meanwhile, 14,680/75 becomes the key support area for pair traders to watch as it comprises the resistance turned support as well as an ascending trend line from May 04.

In a case where the bears manage to conquer 14,675 support, the early March high near 14,420 could gain the market’s attention.

USD/IDR daily chart

Trend: Further recovery expected