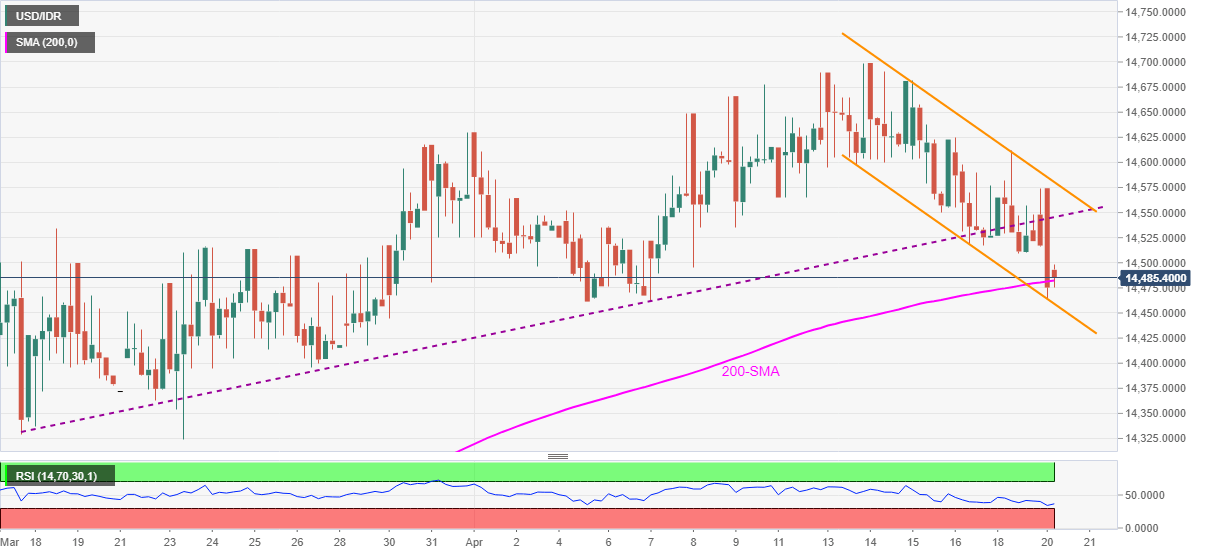

- USD/IDR stays depressed near two-week low, bears attack intraday bottom off-late.

- 200-SMA, lower line of weekly falling channel test further downside.

- Bank Indonesia is widely expected to keep benchmark rate unchanged near 3.5%.

USD/IDR fails to extend the bounce-off intraday low while teasing $14,500 during early Tuesday. In doing so, the Indonesian rupiah takes the bids ahead of the Bank Indonesia (BI) Rate Decision.

However, 200-SMA and short-term descending channel’s lower line, respectively around $14,480 and $14,460, challenge the pair’s immediate downside.

It’s worth mentioning that the BI is likely to keep benchmark rates unchanged near 3.5% but fears of growth prospects and the coronavirus (COVID-19) can trigger the USD/IDR bounce.

Though, the previous support line from March 17, around $14,550, followed by the stated channel’s upper line near $14,580, should restrict the short-term recovery moves.

Meanwhile, USD/IDR bears’ dominance below $14,460 will eye for the December 2020 high surrounding $14,330.

USD/IDR four-hour chart

Trend: Pullback expected