- USD/IDR remains below 100-DMA despite better than forecast inflation data.

- 21-DMA offers nearby support to the quote.

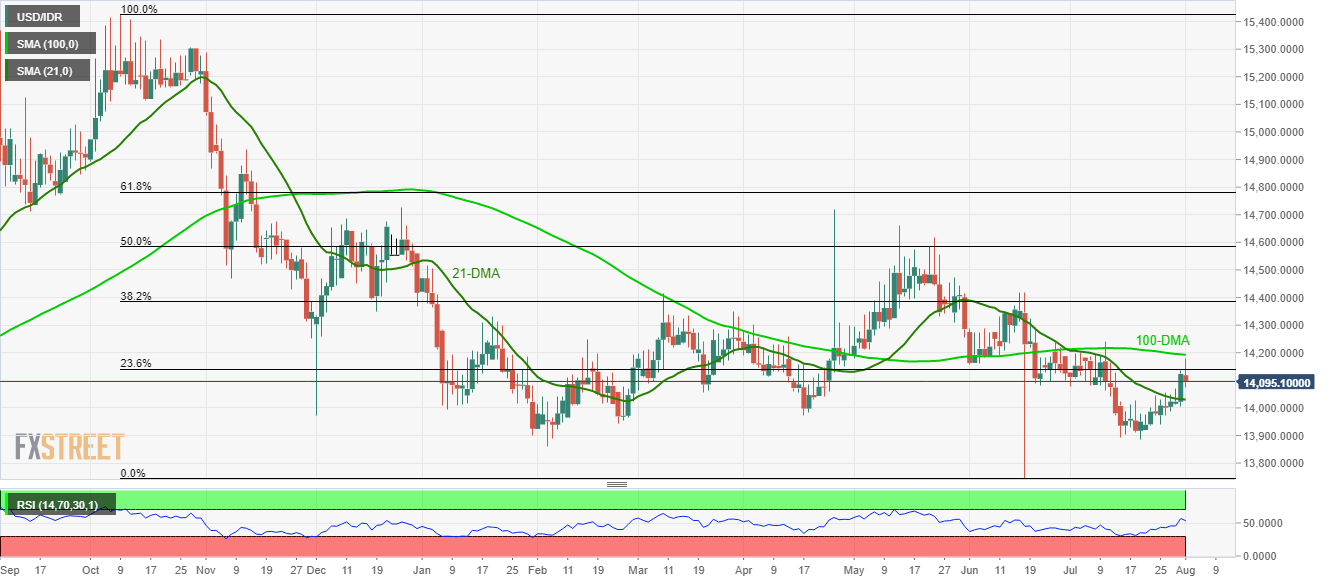

The 100-DMA keeps restricting the USD/IDR pair’s upside despite Indonesian inflation largely beat expectations on early Thursday. The quote now seesaws around 14,096 just after the data release.

The headline Inflation (YoY) grew past-3.27% forecast to 3.32% during July whereas the monthly outcome crossed 0.26% consensus to 0.31%. Further, Core Inflation marginally came ahead of 3.17% anticipations to 3.18% on a yearly basis.

Even so, the 100-day moving average (DMA) at 14,192 keeps limiting the pair’s upside, a break of which can trigger the quote’s fresh rally towards July month high near 14,240.

It should also be noted that the pair’s rise past-14,240 can propel it towards 38.2% Fibonacci retracement level of 14,385.

On the downside, 21-DMA level of 14,030 and 14,000 round-figure can lure sellers during the pullback ahead offering them July low surrounding 13,884.

USD/IDR daily chart

Trend: Bearish