- USD/INR remains on the front foot while refreshing the record high.

- Bearish MACD, nearly overbought RSI could trigger pullback from the upper bank of the Bollinger.

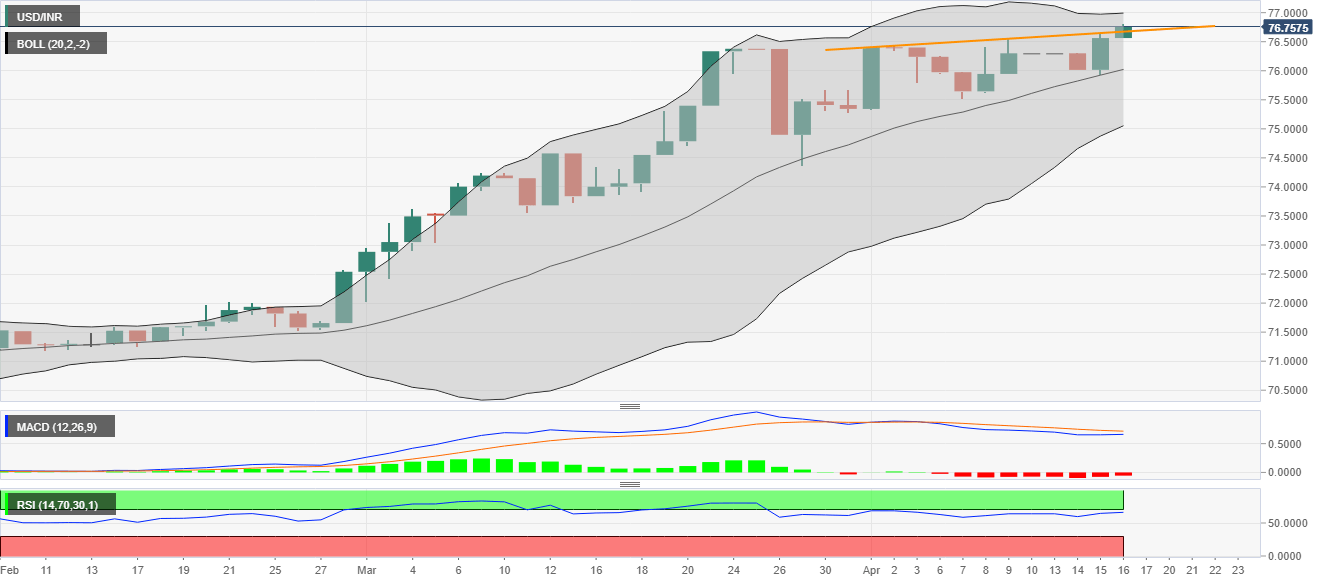

After multiple attempts to take out the monthly ascending trend line, USD/INR refreshes the record high to 76.82, currently up 0.25% to 76.77, ahead of the European market open on Thursday.

The pair currently rises towards the upper bank of the Bollinger, near 77.00, but overbought RSI conditions and bearish MACD might trigger a pullback around then.

However, sellers are less likely to enter the trade unless the pair drops below the resistance-turned-support line, at 76.67 now, while targeting the middle-band of the Bollinger, near 76.02.

It should also be noted that any further selling below 76.02 will target March 27 low surrounding 74.36.

On the fundamental side, the International Monetary Fund’s (IMF) warning for Asian economies and the coronavirus outbreak in India seems to keep the pair buyers hopeful.

USD/INR daily chart

Trend: Bullish